Good Morning,

Stocks closed little changed on Friday as solid quarterly results from some of the largest U.S. companies, including Microsoft, Capital One and Honeywell, counterbalanced threats made by President Donald Trump stating that he is willing to up the ante in the trade war with Beijing and could slap tariffs on every Chinese good imported to the U.S. "I'm ready to go to 500," he told CNBC, referencing the $505.5B of American imports from China in 2017, compared to the $129.9B the U.S. exported to the country last year. (an interesting blow by blow look at global trade here)

In other news, President Trump sat down with Russian counterpart Vladimir Putin in Helsinki. Crimea, Syria and election meddling were likely on the summit's agenda, but no aide or official from the U.S. delegation were present during the meeting's initial stages. A controversial press conference ensued (in which Trump seemed to prefer Putin’s story suggesting Russia’s non-involvement in the US election rather than the opinion of U.S. intelligence), coming on the tails of a tense NATO summit during which Trump lambasted allies for not meeting their defense spending commitments.

The 10-year yield ended the week at 2.90% and the two-year yield finished up at 2.60%. Some analysts saw the increased 2-10 spread as a sign that investors believe President Trump's criticism of the Fed could slow down the pace of rate hikes.

Finally, Amazon reached a $900B market value for the first time, nipping at Apple's) heels as Wall Street's most valuable. The news comes after the company announced it sold more than $100M in products during its annual Prime Day sale. Shares are up over 57% so far this year, bringing Amazon's increase to over 123,000% since it listed on the Nasdaq in 1997.

Our Take

As perplexing as Trump’s actions can be, instead of spilling more ink on his diversions from “accepted” presidential behavior, it may be best to try and understand his approach by attempting to apply a different mental model. The seeds of Trump’s mental model can be found in his book “The Art of the Deal”. (His approval ratings also hold other clues)

Jim Rickards points out that the book is a window on Trump’s approach to every challenge he confronts, including economic and geopolitical challenges as president.

What is Trump’s process as described in the book?

Identify a big goal (tax cuts, balanced trade, the wall, etc.).

Identify your leverage points versus anyone who stands in your way (elections, tariffs, jobs, etc.).

Announce some extreme threat against your opponent that uses your leverage.

If the opponent backs down, mitigate the threat, declare victory and go home with a win.

If the opponent fires back, double down. If Trump declares tariffs on $50 billion of good from China,and China shoots back with tariffs on $50 billion of goods from the U.S., Trump doubles down with tariffs on $100 billion of goods or perhaps even $505.5 billion etc. Trump may keep escalating until he wins. (or loses)

Eventually, the escalation process can lead to negotiations with at least the perception of a victory for Trump (North Korea) — even if the victory is more visual than real.

This approach is abnormal from a historical perspective but to the astute observer this far into his Presidency should be looking more predictable.

What should we expect moving forward in light of this mental model? Likely more dramatic policy shifts and extreme threats. The key is not to overreact and hope that all escalations lead to fruitful negotiations in step 6….

Chart(s) of the Month

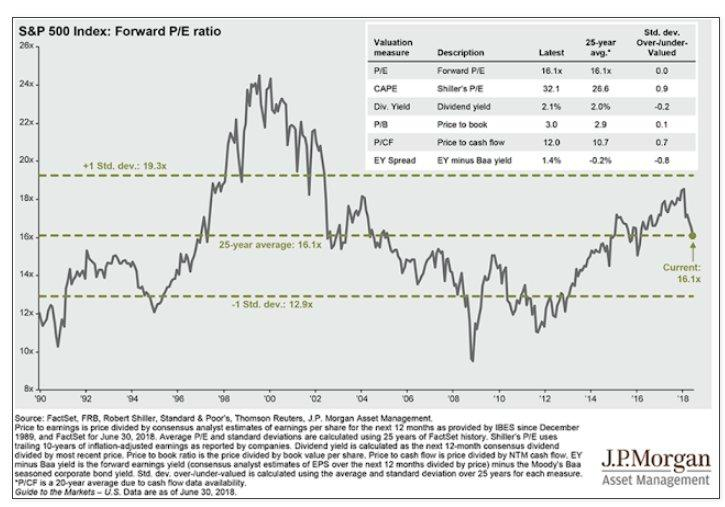

The S&P 500 PE ratio is right in line with historical norms.

J.P. Morgan: “High yields spreads and defaults are low and not rising. Mr. Bond is not yet sniffing a potential economic problem.”

The Big 5 tech companies together are worth more than the bottom 282 companies in the S&P 500 yet this level of concentration is not unprecedented. In 1965 AT&T and GM represented 14.5% of the S&P 500. What is wild is that these 5 companies are all in the same industry.

Courtesy of Michael Batnick.

Musings

This month we released our 2nd quarter letter to our investors. Included is a discussion of portfolio changes as well as a more detailed description of a new position we’ve initiated in Industrial Alliance and Financial Services (TSX: IAG). Please contact us if you would like to see a copy of this letter.

Logos LP May 2018 Performance

June 2018 Return: 4.29%

2018 YTD (June) Return: 0.34%

Trailing Twelve Month Return: +11.86%

CAGR since inception March 26, 2014: +18.77%

Thought of the Month

"Do you have the patience to wait till your mud settles and the water is clear? Can you remain unmoving till the right action arises by itself?”– Lao-Tzu, Tao-te-Ching

Articles and Ideas of Interest

- These 10 stocks account for all the S&P 500’s first half gains.David Kostin, chief U.S. equity strategist at Goldman Sachs, highlighted that more than 100 percent of the S&P 500’s total return of nearly 3 percent in the first half is attributable to just 10 equities. Amazon.com Inc. alone accounts for roughly two-fifths of the benchmark gauge’s advance. Find out which they are here.

The average age of a successful startup founder is 45. HBR explores why and also why vc investors often bet on young founders.

- YOLO. A Boston College study has found that half of companies raising through ICOs die within four months after finalizing token sales. Is Blockchain even a revolution?

- Longer lives mean a single marriage may not be enough. More couples are wondering if the relationship they had in their first phase of adulthood is worth continuing.

We have reached peak screen. Now revolution is in the air. Screens are insatiable. At a cognitive level, they are voracious vampires for your attention, and as soon as you look at one, you are basically toast. There are studies that bear this out. One, by a team led by Adrian Ward, a marketing professor at the University of Texas’ business school, found that the mere presence of a smartphone within glancing distance can significantly reduce your cognitive capacity. Your phone is so irresistible that when you can see it, you cannot help but spend a lot of otherwise valuable mental energy trying to not look at it.

- Can the cult of Berkshire Hathaway outlive Warren Buffett? Centuries from now, historians piecing together the narrative of this stretch of America’s existence will have to explain the curious four-decade (and counting) run in which an arena in an otherwise modest midwestern US city filled to capacity once a year for two aging billionaires talking about the stock market, life, and whatever else tickled their fancy. The annual meeting of the Omaha, Nebraska-based holding company Berkshire Hathaway has no analog in US business or culture. Buffett is 87. Munger is 94. And Berkshire Hathaway’s returns over the S&P 500 are slowing, as Buffett has warned for decades they would. Interesting article in Quartz exploring his legacy as well as his adage that America will always remain a safe bet...

- Google is building a city of the future in Toronto. Would anyone want to live there? It could be the coolest new neighborhood on the planet—or a peek into the Orwellian metropolis that knows everything you did last night. Politico magazine explores the tradeoffs and debates involved.

- In praise of being washed. Has a life of ambition and striving gotten the best of you? Do you sometimes wish you could give up a little—stop chasing so many pointless goals you probably won’t hit anyway? It’s time you got washed. A refreshing summer read in GQ.

- Scientists at a company part-owned by Bill Gates have found a cheap way to convert CO2 into gasoline. A team of scientists has discovered a cheap, new way to extract carbon dioxide from the atmosphere — which could arm humanity with a new tool in the fight against climate change.

- The friend effect: why the secret of health and happiness is surprisingly simple. Our face-to-face relationships are, quite literally, a matter of life or death. “One of the biggest predictors of physical and mental health problems is loneliness,” says Dr Nick Lake, joint director for psychology and psychological therapy at Sussex Partnership NHS Foundation Trust. “That makes sense to people when they think of mental health. But the evidence is also clear that if you are someone who is lonely and isolated, your chance of suffering a major long-term condition such as coronary heart disease or cancer is also significantly increased, to the extent that it is almost as big a risk factor as smoking.”

Our best wishes for a fulfilling month,

Logos LP