Good Morning,

Stocks slumped on Friday as increased tensions between Ukraine and Russia sent oil spiking and led investors to dump risky assets like equities. Shares were mostly flat on the day until Ukraine-related headlines in afternoon trading caused traders to dump stocks and buy Treasuries.

With about 2 hours left in the trading day, U.S. National Security Advisor Jake Sullivan said at a White House briefing that there were signs of Russian escalation at the Ukraine border and that it was possible that an invasion could take place during the Olympics, despite speculation to the contrary.

Both the U.S. and U.K. have called for their citizens to leave Ukraine as soon as possible. Sullivan noted that the U.S. is not certain that Russian President Vladimir Putin has made a final decision to invade Ukraine. But “it may well happen soon,”

This week’s volatility in the bond market started after a hotter-than-expected inflation reading on Thursday, which prompted St. Louis Fed President James Bullard to call for accelerating rate hikes — a full percentage point increase by the start of July.

Goldman Sachs shifted its expectations for the Fed this year, calling for seven rate hikes in an effort to cool an economy that has generated inflation far more persistent than policymakers had anticipated.

Our Take

What a difficult environment. It’s as if with every passing day the macro environment deteriorates and the outlook for 2022 grows more fragile.

We believe that investors should avoid wasting time on things that are unknowable and unimportant and focus primarily on things that are knowable and important. Nevertheless, some unknowable questions such as the direction of interest rates, how high inflation will go and where the economy is headed are important.

Yet how do we confront their importance if they are unknowable? To study such questions, we practice looking at facts and deriving probabilistic statements. Not whether we will be right or wrong but rather: “What is the probability of this scenario versus another, and how does this information affect my assessment of value?”

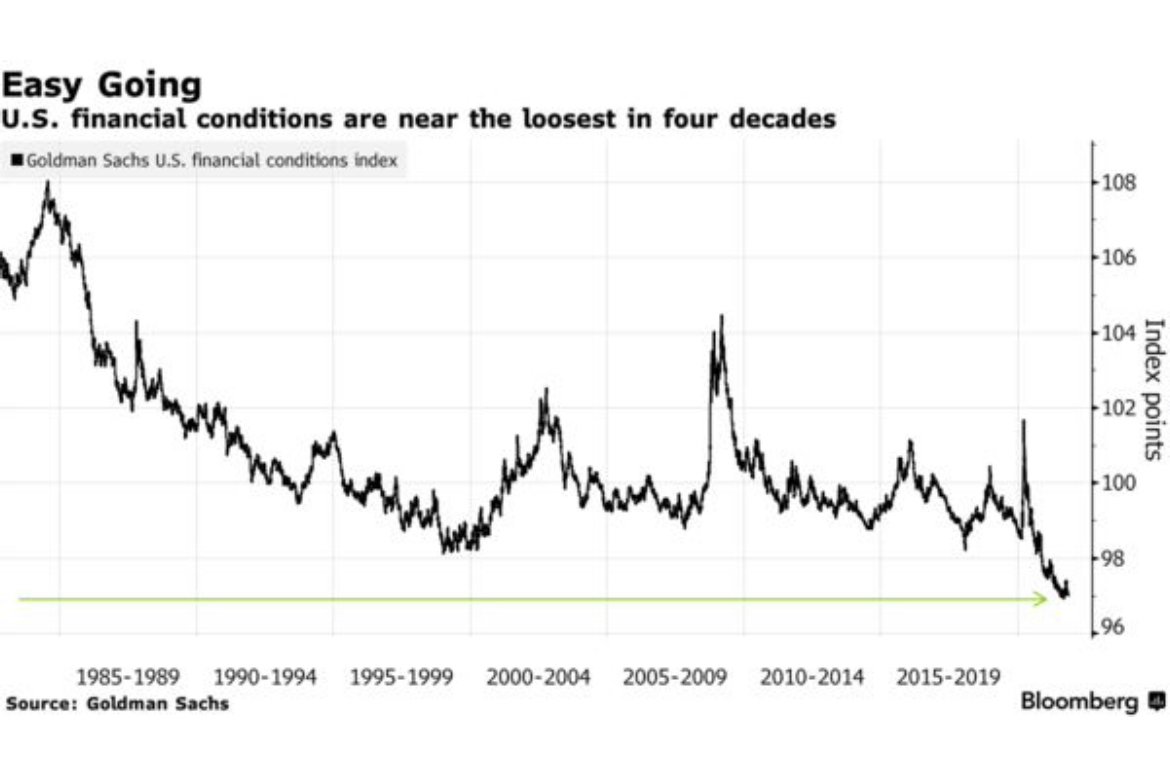

When it comes to the unknowable yet important macro questions above, we believe as we stated back in November, that governments and central banks are caught between a rock and a hard place. They face persistent above trend inflation that is poorly understood while their economies’ fundamentals weaken, dependence on loose monetary policy becomes entrenched, debt burdens continue to rise, and politicians have gone all in on anti-growth/anti-business populism.

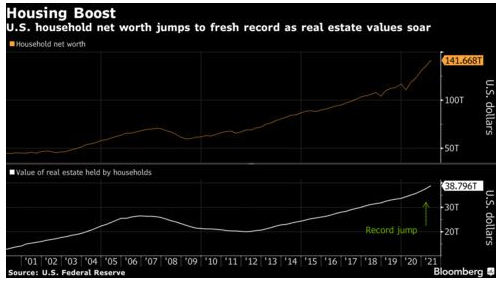

We still maintain this view, yet even after the historic selling which kicked off 2022, we see the potential for more downside as the piper collects his due. Both the Fed and Joe Biden’s credibility are now on the line as too many people are suffering from the effects of stubbornly “non-transitory” inflation. The issue is now political and with 40% of American voters holding no stake in asset markets, the Fed will find it very hard to pivot away from established tightening expectations.

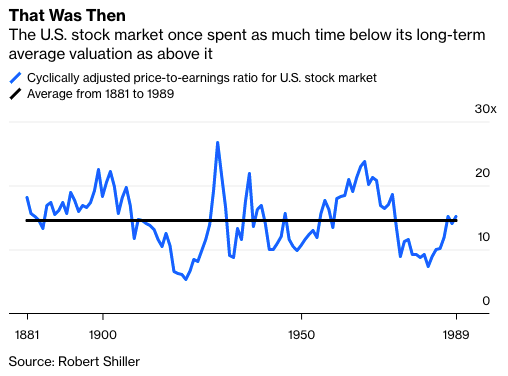

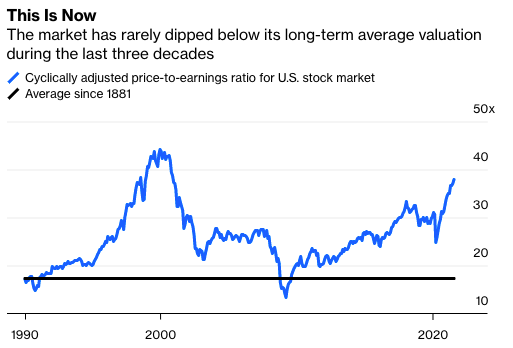

The Fed will be tightening into fading cyclical growth momentum at peak valuations, significantly raising the probability of additional drawdowns.

Core to the slowing growth view are peak/declining readings on various well-known inputs like ISM New Orders, US Consumer Confidence, trade weighted US$, US BBB credit spreads, and Global Manufacturing PMIs. Bond markets seem to agree as the gap between the 2-year and 10-year Treasury yields has sunk to its lowest since late 2020.

Unfortunately, the Fed looks poised to tighten for the wrong reasons (slowing runaway inflation in an economy with a backdrop of weak fundamentals) rather than for the right reasons (slowing runaway inflation in an economy with a backdrop of strong fundamentals). It should also be noted that investors underestimated how much the Fed would raise rates in the last three tightening cycles, so there is a risk that the Fed may tighten more than expected this time around.

Bottom line, the probability of profit growth momentum peaking and slowing through 2022 and even into 2023 is high. With 4Q earnings underway, the slowdown is already apparent. The pace of positive surprise has slowed meaningfully in 4Q21 with fewer positive revisions to subsequent quarter forecasts and corporate guidance has returned to its mildly negative average. The slowing rate of change is how weakness begins…

China is also an important leading indicator (typically as goes China, goes the West) and their central bank has already begun an easing blitz with fresh rate cuts. A serious Chinese economic downturn would endanger growth everywhere.

Despite the above, we must stress that this environment is fluid. As a result, we will remain defensive yet will not hesitate to shift to offense if the pendulum swings too far towards extreme fear.

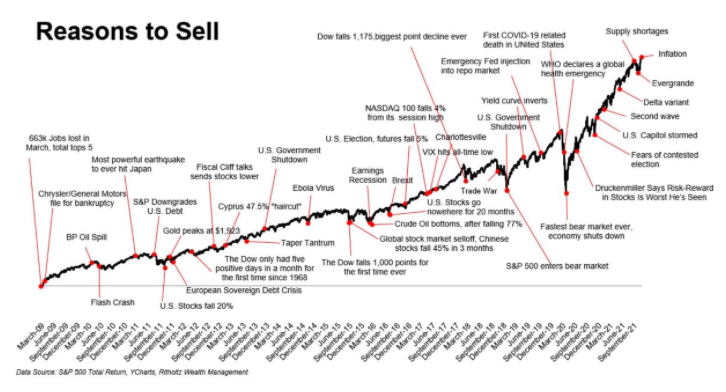

This is a challenging environment with the worst start to the year since January 2009, but for the long-term investor, there is always opportunity amidst volatility. The long-term investor’s portfolio is not, nor should it be, immune to rough patches. After all, to enjoy the benefits of compounding, such patches must be endured.

The long-term investor should remain focused on allocating capital to assets based on well-reasoned estimates of their potential and remain confident that with patience, the storm will pass as it always does.

“To make money in stocks, you need to have vision to see them, courage to buy them and patience to hold them. Patience is the rarest of the three.” -Thomas Phelps

Musings

Looking back on 2021 at Logos LP with an eye to 2022 we’ve put most of our energy into honing the definition of our “circle of competence”.

“I’m no genius, but I’m smart in spots, and I stay around those spots.” -Tom Watson Sr.

As liquidity is drained and capital becomes more discerning, the ability to correctly evaluate “select” businesses is paramount. As opportunity sets improve, the importance of knowing our sweet spots increases.

At its core, our circle of competence includes durable, high-quality (growth security and deliverability) businesses that are trading at reasonable (or cheap) valuations relative to their long-term earnings power. If we are able to develop a deep understanding of these businesses and establish confidence in their long-term business results, we will build meaningful stakes.

No single strategy works in every kind of market yet we believe that long term, having a concentrated portfolio composed of such businesses will offer the best odds of outperformance.

As the Fed moves down a tightening path and elevated market volatility compresses multiples, dislocations are beginning to create attractive opportunity sets in our sphere of competence. One sector in which we are seeing the most attractive opportunity set of relative value per unit of fundamentals is healthcare/life sciences.

At present, the healthcare sector typifies the “quality value” factor trading at a roughly double discount relative to the broader market. This sector offers well above market FCF yield, double digit sales growth and low volatility of sales. Relative earnings for the sector (vs. other sectors) also appear to be poised for improvement which can support outperformance. This is before considering the secular forces of aging populations, growing demand for health and wellness as well as treatments for complex and chronic diseases. Such factors also underpin the secular trends currently fueling investment in healthcare sub-sectors including healthcare services, infrastructure, and research globally.

We believe these sub-sectors hold some of the most important innovations of our lifetime, in addition to possessing some of the most durable tailwinds we have seen in a post-Covid world. According to EvaluatePharma, by 2026, global pharmaceutical R&D spend is expected to reach $233 billion coinciding with US national healthcare expenditures increasing at a 5.5% CAGR between 2019 and 2028. These secular tailwinds should continue to drive greater demand for diagnostics and novel therapeutics, addressing the world's most complex and onerous disease threats, such as cancer, Alzheimer’s, and other life-altering diseases.

There are currently more compounds in Phases 1-3 of clinical trials than in any other period in history (Figure 1). Additionally, the number of biotech formations and catalysts (these are measured by FDA approvals, audits, readings, or patient output) has declined to 9-year lows due to: 1. Covid delays; 2. No FDA head for the 9 months prior to October 2021; 3. Fluctuating lockdowns impacting clinical trials (Figure 2). This has led to one of the lowest valuation troughs for the small-to-mid cap biotech sector over the past 20 years (Figure 3) and the longest (and largest) drawdowns for the XBI vs. the SPY in history (Figure 4).

Figure 1:

Source: Pharmaprojects 2020

Figure 2:

Source: Evaluate Pharma; Bloomberg; Wedbush Securities, Inc. Research

Figure 3:

Source: Wells Fargo Securities

Figure 4:

Source: Wells Fargo Securities

Additionally, the biotech sector is well capitalized with high quality assets during a period in which cash rich big pharma will likely look to M&A as they face imminent patent cliffs.

Within the complex described above, we believe the optimal approach is to look at the ‘compounder’ businesses that are less cyclical, possess oligopolistic characteristics, very strong pricing power and are comfortable with share buybacks.

We are currently focusing on a few businesses that meet these criteria including:

1. Charles Rivers Laboratories (CRL) – Provides CRO services to roughly 80% of all FDA approved compounds.

2. West Pharmaceuticals (WST) – Holds 70% market share in drug packaging and has been involved in 90% of all biologics delivery since 2019.

3. Repligen (RGEN) – Has a virtual monopoly on ligand A proteins, a key ingredient for any FDA approved vaccine or therapeutic.

Given the make-up of the economy in a post-Covid world, we believe this rare breed of business is well positioned to take advantage of certain secular tailwinds that will likely be present over the next decade and will provide attractive long-term IRRs. Furthermore, this view is supported by peaking cyclical growth as well as a slowing pace of earnings growth as 2022 progresses (see above). Slowing growth elsewhere will favor the growth security and deliverability of such businesses in the healthcare/life sciences sector.

Charts of the Month

The gap between 5- and 30-year yields narrowed to less than 40 basis points, the smallest since the Fed was at the end of its last rate-hike campaign in 2018. That signals speculation that economic growth will slow as the Fed tightens monetary policy.

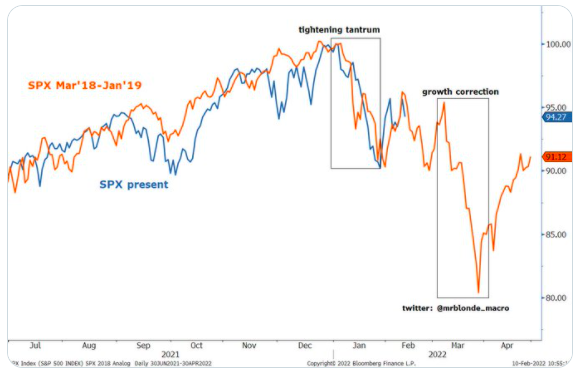

History doesn't repeat but it sure does rhyme. Tightening tantrum followed by growth correction…

Earnings revisions and outlook views tend to begin with a trickle and then the downward revisions lead to a change in the consensus outlook…

Historical look at core goods minus core services inflation with recessions … spread is more negative now than at any point going back to late-1950s.

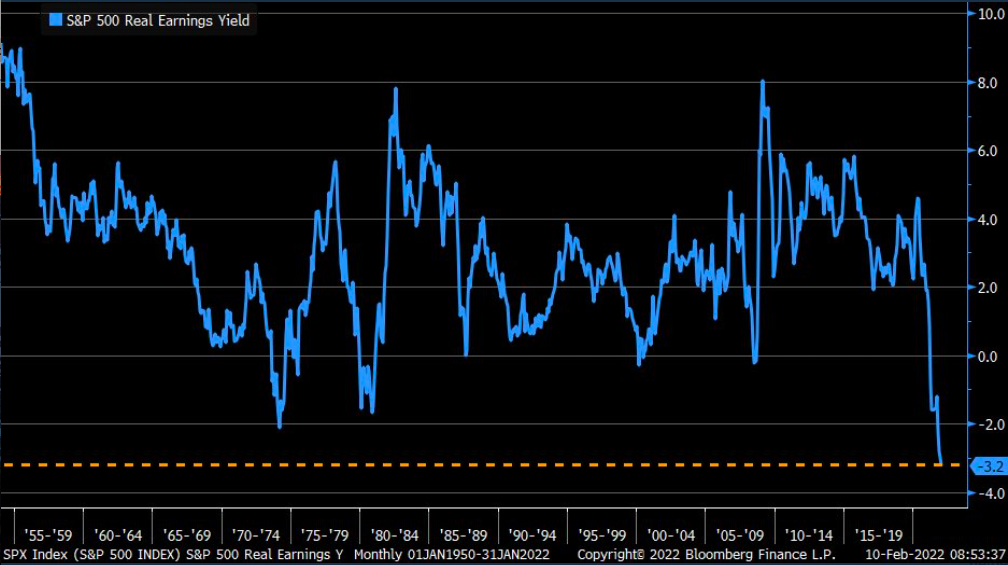

The S&P 500’s real earnings yield continues to plunge; now at -3.2% (an all-time low). We are living in the upside down…

When if ever will China take the number one spot? Maybe never..

Mid term years can be ugly…

Logos LP December 2021 Performance

December 2021 Return: -9.46%

2021 YTD (December) Return: 4.82%

Trailing Twelve Month Return: 4.82%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: 22.58%

Thought of the Month

“People who arbitrage time will almost always outperform. The first order thought of instant gratification is a crowded path, ensuring mediocre results at best. Delayed gratification, which requires second order thinking, is less crowded and more likely to get results.” — Shane Parrish

Articles and Ideas of Interest

Does the national debt matter? For decades now, there have been many over-simplistic views on government debt. Some people were acting as though it would be a near-term catastrophe thirty years ago, and it never was. On the other hand, there are people who say it barely matters at all, ironically when it’s probably starting to actually matter. As with most things in life, the truth is somewhat more nuanced. This article by Lyn Alden dives into some of the details as far as the available data are concerned.

The great climate backslide: How governments are regressing worldwide. From the U.S. to China, harsh economic realities mean the political will for painful choices is evaporating fast. In 2022, a toxic combination of political intransigence, an energy crisis and pandemic-driven economic realities has cast doubt on the progress made. If 2021 was marked by optimism that the biggest polluters were finally willing to set ambitious net-zero targets, 2022 already threatens to be the year of global backsliding.

When will China be the world’s biggest economy? Maybe never. When will China outstrip the U.S. to claim the top spot in the world economic rankings? For Beijing, it would be convenient if everyone viewed that transition as inevitable and imminent. The reality is as Bloomberg outlines, it’s anything but. A debt crisis, demographic drag, and international isolation could all keep China stuck in perpetual second place.

Are we cultivating a generation of failed startup founders? Are we driving innovation, or instilling false hope in wannabe entrepreneurs? Medium’s largest publication is The Startup, with more than 700,000 followers. Hundreds of thousands of people who are curious about startups, have created one themselves or plan to build one in the future. More and more people are joining the conversation. More and more people are starting their own side hustles or full-time ventures because they’re hoping that it will lead them to success. Can all these people make it? Can so many people change the world in a million different ways? Or might we be better off encouraging these people to search for secure jobs, so they contribute to the economy in a safe and predictable way? Very interesting article examining the implications of the cult of the “startup”.

The big question: how long can private market multiples stay elevated while young public companies compress? The median ARKK holding traded for 33x sales in early ’21. Today it’s 9x and going lower by the day. There is almost certainly a tipping point, but Michael Batnick thinks this dichotomy can last longer than most people think. There’s too much money chasing too few deals in private markets, and an interest rate hike or two may not change that.

The lockdown catastrophe. Where are the public health benefits to justify Covid-era shutdowns and spending? Government disease doctors and politicians around the world panicked in the face of Covid and began shutting down societies in early 2020. The accounting has hardly begun on the impact of isolating human beings, denying them opportunities, education and experiences—not to mention disrupting non-Covid medical treatments and myriad other valuable services—and then attempting to simulate the benefits of a functioning society by printing fiat money. It will take years to understand the full cost of this man-made catastrophe, But emerging research suggests that on the other side of the ledger, public health benefits were extremely small, if they can be verified at all. The WSJ digs into the results of a new study on the effects of lockdowns by Johns Hopkins economist Steve Hanke and colleagues from Denmark and Sweden.

Some good observations from Michael Batnick about 2021. What makes this game fun and exciting is that there is no handbook where we can observe the rule changes. All we have are numbers on a screen. When something that worked for 30 years stops working, how long before we pick up on the shift? My favourite: avoid extremes.

The capital sponge. Why have US stock outperformed for so long? Lyn Alden suggests that the US put in place a set of policies over the past four decades that pulled a lot of domestic and global capital into its stock market. This naturally had some pros and cons associated with it. Each country generally has a set of political priorities, and those priorities can change over time. Compared to other developed nations, the US has favored its corporate sector above most else since the early 1980s, which made the US stock market an attractive sponge to absorb capital from everywhere. As a result, the US stock market capitalization currently represents 61% of the global stock market capitalization, despite the fact that US GDP is only 23% of global GDP. Are the factors behind this trend running out of steam?

Our best wishes for a year filled with discovery and contentment,

Logos LP