Good Morning,

Last week the S&P 500 Index pushed past 2,500 for the first time, notching its third round-number milestone of the year as the bull market in U.S. equities rages on. With a gain of 10.4% through the end of August, this year ranks as the fourth best start to a year in the last ten years, behind 2013 (+14.5%), 2009 (+13.0%) and 2012 (+11.8%).

The benchmark gained 0.2 percent to 2,500.23 last Friday, capping its biggest weekly advance since January, as technology shares rebounded and banks climbed with Treasury yields. Up 12 percent since January, the S&P 500 is on course for its best annual gain in four years.

Equities broke out of a month long trading range after the worst-case scenarios from Hurricane Irma and North Korea failed to materialize. As geopolitical fears subsided, investors shifted focus back to fundamentals, where economic growth remains stable and corporate earnings are expected to increase every year through at least 2019.

Another piece of good news last week: America's middle class had its highest earning year ever in 2016, the U.S. Census Bureau reported Tuesday. Median household income in America was $59,039 last year, surpassing the previous high of $58,655 set in 1999, the Census Bureau said.

Our Take

Strength is appearing to beget strength. In each of those three years above (2013, 2009, 2012) where the S&P was up significantly in the first eight months of the year, the remainder of the year saw further upside with a median gain of 9.3%.

In addition to those three years, the last four months of each calendar year has been strong throughout the entire bull market. The S&P 500 has been up every time for a median gain of 3.4%.

On a total return basis, the the index was up an impressive 16.2% over last year through the end of August. The historical average is 11.7% going back to 1928. Can things continue?

The trend may be up but either way we subscribe to a more reserved view well described in a note entitled “Yet Again?” released last week by Howard Marks. In this memo, which served as a follow up to his other recent memo entitled “There They Go Again” released on July 26, Marks suggests that investors are no longer being offered value in the market at cheap prices and thus should pull back and be less aggressive. Marks suggested that the market is not currently a “nonsensical bubble” but rather is simply high and therefore risky.

Risk may have increased as prices have risen yet the interesting question then is: “So what should we do?” At our 2017 high this year our fund was up roughly 25%. We have since come off this high and are in the process of re-calibrating our expectations in what we believe to be a more “low-return” environment. What does this mean?

As Marks reminds us in his memo the options are limited:

Invest as you always have and expect your historic returns.

Invest as you always have and settle for today’s low returns.

Reduce risk to prepare for a correction and accept still-lower returns.

Go to cash at a near-zero return and wait for a better environment.

Increase risk in pursuit of higher returns.

Put more into special niches and special investment managers.

#1 would make no sense.

#2 is difficult.

#3 makes sense if you think a correction is coming but could cost you.

#4 is tough as zero-returns are rarely ever acceptable.

#5 is deceptive as high risk does not assure higher returns. It means accepting greater uncertainty with the goal of higher returns and the possibility of substantially lower (or negative) returns.

#6 is good as they can offer higher returns without proportionally more risk. That is if they can be identified.

Like Marks, we believe that none of these options is perfect but that there are no others. Thus, as we re-set expectations in an environment promising lower returns we will do the things we have always done remaining largely fully invested and accept that returns will be lower than they traditionally have been (#2). While we do what we have always done we will employ more caution than usual especially with regards to price (#3) and we will work diligently to find special opportunities that lie “off the beaten track” (#6).

Musings

I attended a conference this week in Toronto called Elevate TO. The purpose of the conference was to showcase the City as a growing hotbed of innovation. The presenters ranged from local politicians, to start-up founders to Canadian technology luminaries. One talk by Salim Ismail the technology entrepreneur and best-selling author of Exponential Organizations really stood out. (for a youtube video see here)

The crux of his talk is that society needs to shift from linear thinking to exponential thinking in order to adapt to a world which is changing faster than our institutions and minds can keep pace with.

But what is linear bias? We’ve seen consumers and companies fall victim to linear bias in numerous real-world scenarios. Although there are many such examples, a nice one relates to intangibles like consumer attitudes.

In a recent HBR article the author suggests looks at consumers and sustainability. We frequently hear executives complain that while people say they care about the environment, they are not willing to pay extra for ecofriendly products. Quantitative analyses bear this out. A survey by the National Geographic Society and GlobeScan finds that, across 18 countries, concerns about environmental problems have increased markedly over time, but consumer behavior has changed much more slowly. While nearly all consumers surveyed agree that food production and consumption should be more sustainable, few of them alter their habits to support that goal.

What’s going on? It turns out that the relationship between what consumers say they care about and their actions is often highly nonlinear. But managers often believe that classic quantitative tools, like surveys using 1-to-5 scales of importance, will predict behavior in a linear fashion. In reality, research shows little or no behavioral difference between consumers who, on a five-point scale, give their environmental concern the lowest rating, 1, and consumers who rate it a 4. But the difference between 4s and 5s is huge. Behavior maps to attitudes on a curve, not a straight line.

Companies typically fail to account for this pattern—in part because they focus on averages. Averages mask nonlinearity and lead to prediction errors. For example, suppose a firm did a sustainability survey among two of its target segments. All consumers in one segment rate their concern about the environment a 4, while 50% of consumers in the other segment rate it a 3 and 50% rate it a 5. The average level of concern is the same for the two segments, but people in the second segment are overall much more likely to buy green products. That’s because a customer scoring 5 is much more likely to make environmental choices than a customer scoring 4, whereas a customer scoring 4 is not more likely to than a customer scoring 3.

This illustration does a great job to outline the problem. The current climate of rapid technological development and change is rooted in exponential thinking. If you look at the biggest problems in the word such as the climate change, economic growth, pandemics and sociopolitical upheaval etc. they are rooted in exponential accelerators and factors. The problem is that many of us (including our leaders) don’t understand this phenomenon and this is the fundamental cognitive gap that we are facing. This gap is causing immense stress as evidenced by the increasing failure of our institutions (Occupy Wallstreet, the Arab Spring, the election of Donald Trump, the surge in nationalism, racism and authoritarianism) which were created in a fundamentally linear world.

When you have an information based environment it goes into an exponential growth path and it starts doubling in price performance every 1 to 2 years. Now we have whole industries and livelihoods like music, newspapers, retail, manufacturing etc. caught up in this vortex of exponential creative destruction as our world is not set up for this.

When you think about all the mechanisms we use to run the world: our social structure, our civics, our politics, our legal systems, our patent systems, our monetary policy systems, our financial systems, our healthcare systems, our education systems they are all geared for the linear world of 100 or 200 years ago when information was scarce. Lets remember that marriage was invented about 15 000 years ago when lifespans were about 25. You grew up, had kids and you died. Was it really designed to last 50-60 years? What happens when lifespans hit 120-150 years?

These mechanisms are all breaking or are already broken. We simply aren’t set up for the exponential world of today and certainly not for the world of tomorrow.

Most of the changes that set this exponential world in motion happened about 25 years ago with the advent of the internet yet now we have moved into the world of 3D printing, AR/VR, synthetic biology, blockchain technologies, advanced robotics and artificial intelligence.

We have a forcing problem with technology. Moore’s law has been doubling computing power for over 60 years and now we have over 12 technologies operating at that same pace: neuroscience, drones, biotech, and even solar cells are doubling in their price performance every 22 months and have been for over 40 years. At this pace we will hit 100% world energy supply that can be delivered by solar in less than 2 decades...Energy that has been scarce for most of human history is about to become abundant...

These exponential and thus highly disruptive technologies will only increase the stress that currently characterizes our world absent the ability of our leaders and I would argue ourselves to learn how to navigate these technologies and update the mechanisms which run our world grounding them in exponential thinking.

The problem is that if you attempt disruptive innovation in any organization or perhaps mind, its immune system will attack you. All of our organizations and mechanisms we use to run the world are built to resist change and withstand risk. Try and change education: teachers unions attack, try to update transportation: taxi drivers attack, try and marry/date someone outside of your accepted circle: your parents or friends attack, try and actually reform the French economy: the unions attack and your approval ratings tank etc.

We’ve got to solve our immune system problem and the future will belong to those people, those leaders, those businesses and those countries that can do so. Can we scale as fast as technology?

Logos LP August Performance

August 2017 Return: -4.55%

2017 YTD (July) Return: +13.27%

Trailing Twelve Month Return: +13.01%

CAGR since inception: +17.84%

Logos LP in the Media

ValueWalk has done a special feature on us and some of our best ideas that will be released this month. For a teaser please click here.

Thought of the Week

"I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.” -Jimmy Dean

Articles and Ideas of Interest

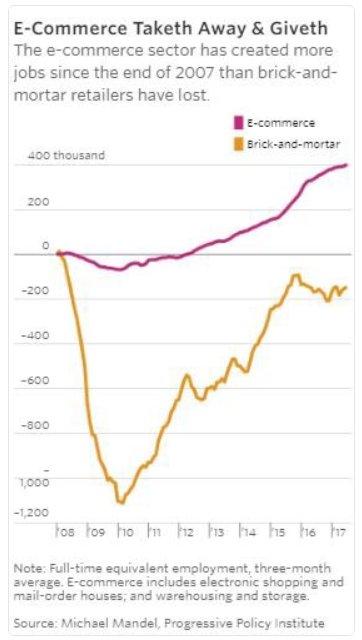

- Robots and AI may not take our jobs after all. Liz Ann Sonders posted the graphic below showing how e commerce has created more jobs that it has taken away.

- Furthermore, automation commonly creates more, and better-paying, jobs than it destroys. Greg Ip for the WSJ explains. Stop pretending you really know what AI is and read this instead.

- What goes up must come down for cryptocurrencies. The summer of bitcoin looks to be ending badly. The biggest cryptocurrency dropped as much as 40 percent since reaching a record high of $4,921 on Sept. 1, cutting about $20 billion in market value. The collapse extended to as much as 30 percent this week since China began sending stronger signals of a clampdown on Sept. 8, making this the biggest five-day decline since January 2015, when it traded at around $200. JPMorgan Chase CEO Jamie Dimon took a shot at bitcoin, saying the cryptocurrency "is a fraud" but can you really blame him given Bitcoin’s status as “the most crowded investment in the world”? Don’t believe the hype about the tremendous returns on “initial coin offerings”. Great piece on ICOs and the promise and perils of global capital markets for everyone. Canada also poured cold water on ICOs in a notice last week, in which regulators there warned that the "coins" in "Initial Coin Offerings"—a popular new way for companies to raise money using cryptocurrency—are likely to be securities. What’s interesting is that with the changing of the tides it hasn’t just been bitcoin tanking. Virtually all cryptocurrencies have taken a beating. Nevertheless, the coins already appear to be recovering...

- In world of supposed bubbles here’s what investors fear most. From Alan Greenspan and the current Federal Reserve staff to fund managers hoarding cash, people feel queasy about asset prices. Euro high-yield debt is trading in line with U.S. Treasuries for the first time ever. Tajikistan is selling Eurobonds as yields on the junkiest emerging markets drop below 6 percent. An exchange-traded fund for betting on low volatility has more than doubled in size this year. And let’s not get started on the bitcoin rally.

- Making money during the apocalypse. Bryan Menegus reports for Gizmodo from a conference whose attendees envisage a future where capitalism is under siege. “The machinery of freedom” apparently will include floating sea colonies, special economic zones, and stateless cryptocurrencies. And it’s up to these elite techno-libertarian attendees to ensure that future happens—whether it benefits the rest of the world or not.

- How Warren Buffett broke American Capitalism. Provocative piece in the FT time suggesting that the investment style of Warren Buffett may have had disastrous effects on the economy. Are “high moats” not simply “monopolies”? Can an investment philosophy have negative effects on an economy?

- Mind control isn’t sci-fi anymore. 2017 has been a coming-out year for the Brain-Machine Interface (BMI), a technology that attempts to channel the mysterious contents of the two-and-a-half-pound glop inside our skulls to the machines that are increasingly central to our existence. The idea has been popped out of science fiction and into venture capital circles faster than the speed of a signal moving through a neuron. Facebook, Elon Musk, and other richly funded contenders, such as former Braintree founder Bryan Johnson, have talked seriously about silicon implants that would not only merge us with our computers, but also supercharge our intelligence.

- The healing power of nature. The idea that immersing yourself in forests and nature has a healing effect is far more than just folk wisdom. Blood tests revealed a host of protective physiological factors released at a higher level after forest, but not urban, walks. Among those hormones and molecules, a research team at Japan’s Nippon Medical School ticks off dehydroepiandrosterone which helps to protect against heart disease, obesity and diabetes, as well as adiponectin, which helps to guard against atherosclerosis. In other research, the team found elevated levels of the immune system’s natural killer cells, known to have anti-cancer and anti-viral effects. Meanwhile, research from China found that those walking in nature had reduced blood levels of inflammatory cytokines, a risk factor for immune illness, and research from Japan’s Hokkaido University School of Medicine found that shinrin-yoku lowered blood glucose levels associated with obesity and diabetes. GET OUT THERE.

Our best wishes for a fulfilling week,

Logos LP