Good Morning,

Major U.S. stock averages rebounded Friday, but closed the week in the red amid fears of the Federal Reserve pulling back its stimulus as well as concern regarding the delta variant.

Minutes from the Fed’s July meeting released this week showed the central bank is willing to start reducing its monthly asset purchases this year. Investors sold equities and commodities this week buying bonds on fears that a “backwards looking” move by the Fed could upend the global economy already under stress by the delta variant.

Our Take

With investors considering a Fed tapering while the delta variant keeps spreading, the transition away from liquidity/policy regime to more mid-cycle markets means volatility is likely set to continue.

Policy error represents the most obvious risk for markets. For weeks, changes in the economic data suggest that economic growth is slowing, rates have been heading lower, the dollar has headed higher, and commodities have by and large corrected. According to the bears, this picture seems to suggest that any Fed tapering this fall - just as the global economy's growth is normalizing - could create a growth scare, and as a result, that theFed would have begun taperingat the wrong moment leading to further economic weakness and eventually a stock market rout.

This may or may not occur. Corrections are inevitable and although we do think that it would be unwise to chase many major index components as future returns from these levels appear unattractive, we do believe that the strength of this bull market is remarkable.

This year alone the S&P has hit 48 new highs. Since we finally broke through the 2007 pre-GFC highs in the summer of 2013 we’re now looking at more than 320 new highs in this bull market. The gains are smaller, befitting a less extreme year as when the S&P 500 Index has risen in 2021, the daily increase has been half what it was in 2020. But in terms of persistent, day-after-day gains, these seven months in the U.S. stock market have few historical precedents.

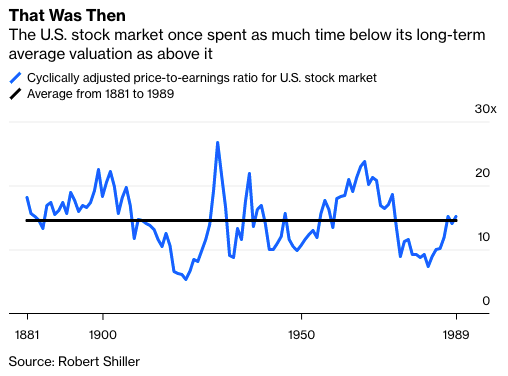

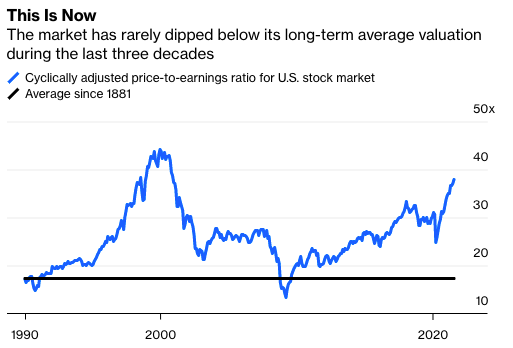

Interestingly, as Nir Kaissar points out for Bloomberg, the past 30 years may not be an anomaly but a new normal.

For about 120 years from the 1870s to the 1980s, the U.S. stock market reliably reverted to its long-term average valuation, and just as important, it spent roughly equal time above and below that average. Investors could therefore expect an expensive market to become cheaper and a cheap market to become more expensive, a useful assumption when estimating future stock returns.

Since 1990, however, the market has rarely dipped below its long-term average valuation, the notable exception being the period around the 2008 financial crisis. Neither the dot-com bust in the early 2000s nor the Covid-induced sell-off last spring managed to subdue it.

Accordingly, with volatility moderate and the uptrend persisting, any trading tools that told investors to do anything but buy are failing. When applied to the S&P 500, half of the 22 charts-based indicators tracked by Bloomberg have lost money since the end of March, back-testing data show. All of them are doing worse than a simple buy-and-hold strategy, which is up 12%.

Over the past 10 years, the S&P 500 is up almost 360% while gold is down 2%. That’s a lost decade for gold, even after it was up 25% in 2020 and 18% in 2019.

It has been incredibly profitable to adhere to the classic mantras of “don’t fight the fed” and “the trend is your friend”. Investors buying virtually every dip have been rewarded.

Most non-recession 10%+ corrections over the past 25 years began with certain conditions. They all typically start with wildly overbought conditions and excessive optimism. We can’t predict when the party will end, but we do believe that “wildly overbought” and “excessive optimism” are not at present characteristic of the prevailing sentiment. Furthermore, for many high quality companies, multiples have been contracting and fundamentals have been improving. You just need to know where to look….

Musings

Humans are creatures of habit and easily susceptible to conditioning. From childhood we learn (the hard way) to avoid touching a hot stove and alternatively, we learn that certain behaviours such as doing our chores will earn us rewards from our parents. We learn (or are supposed to learn) that by working hard and developing the right skills and habits we will get ahead and unlock a more “pleasant” life.

Our environment influences us. We react to the incentives and disincentives we are presented with attempting to reduce pain and maximize pleasure and this process of conditioning shapes our behaviours and attitudes.

The economy and markets work similarly because after all, they are composed of humans. Given the incredible shock Covid-19 represented (which we are still dealing with), we’ve been thinking a lot about the conditioning it has precipitated or perhaps accelerated. How have our brains/habits and thereby societies and economies been re-wired?

Aware of the seemingly endless amount of time one could spend on this topic, one thing in particular has caught our attention.

The fact that the labor force in the US has shrunk (this is a phenomenon that is also affecting most developed economies). The US economy has been creating jobs at a rapid clip. Employment has risen by an average of about 617,000 people per month so far this year.

While the total number of Americans who are working is still more than 5 million short of 2019 levels, there is work available. The number of open positions surged to a record 10 million-plus in June.

Nevertheless, many employers say they’re having trouble filling those jobs, even with the unemployment rate still relatively high.

That points to one big question-mark around the recovery. Americans have dropped out of the labor force.

More than half of the unemployed have been out of work for 15 weeks or longer and, on average, it’s taking people 29.5 weeks to find a job -- even with all those openings.

Why? Common explanations fall into three categories.

Disruption owning to the spread of Covid-19

The Impact of welfare policy

Changes to attitudes wrought by the pandemic

When it comes to the first bucket it is believed that school closures have made it impossible for parents, particularly mothers to take a job. The evidence of this is more mixed and less compelling. Furthermore as restrictions ease, Covid-19 recedes and children head back to school, such issues should correct.

The second bucket is of particular interest as welfare policy (ie. entitlements) is something policy makers can control. Where do we stand on this front? There was an interesting article in the WSJ recently entitled “Hooked on Federal Checks”. The author Nick Stehle wrote:

“My family is receiving the new Advance Child Tax Credit Payments, passed by Congress and signed into law by President Biden in March. Under this policy, I’m going to make more than $11,000 by the time I file my 2021 taxes. I “earned” this extra cash by having four children between 5 and 13.

The policy—which pays $300 a month for each child under 6 and $250 a month for each child between 6 and 17—is set to expire at year’s end, yet the Biden administration and congressional Democrats are pushing to make it permanent. If that happens, I’m looking at more than $10,000 a year for the next four years, then thousands more annually for nearly a decade after that.

Do I need this money? Thankfully, no. I have a good job that puts my family solidly in the middle class. Should I be getting this money? Absolutely not. But will I use the money? Yes. That is why this new entitlement is so dangerous.

The federal government is conditioning families like mine to expect “free” money. When you see that cash in your account, the first thought is how to use it. It becomes a habit to see and spend extra money each month. Like many habits, it is liable to worsen.”

The political discourse in Canada is no different with each challenger party putting forth colossal spending platforms designed to one up the current incumbent Liberal spending bonanza.

Politicians of all stripes continue to clamour for more spending as they decry that life is getting more expensive. All of this while nearly 61% of U.S. households paid no federal income taxes in 2020 and central banks have spent $834 million an hour for 18 months buying bonds to force down borrowing costs since the pandemic hit (the US Fed alone has put in roughly $4 trillion).

The question is how much longer can central banks and governments keep the cash spigots flowing at full force? Politicians appear to be openly uninterested in such trivial details.

Many of the entitlements such as the Advance Child Tax Credit Payments discussed above or the Old Age Security benefits in Canada (only two small examples) are not primarily directed to families in poverty.

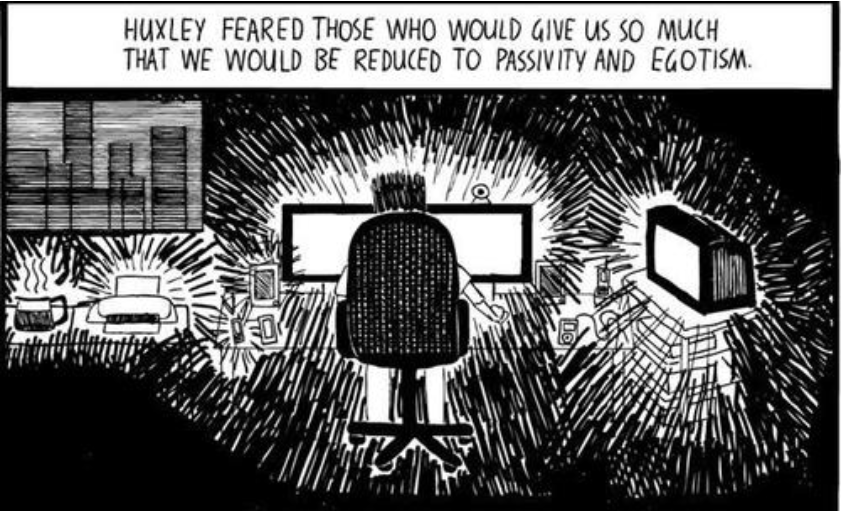

Instead, such entitlements are better understood as an attempt to buy votes from various voting blocks. Once you come to expect an entitlement you are much less inclined to vote for someone who wants to cut off the cash. A similar understanding can be applied to the Canada Emergency Wage Subsidy, CRB, CRCB and the CRSB in Canada. The conditioning has become powerful.

Nick Stehle points out that the price tag of such measures in terms of expanding the national debt is high yet the human cost of these policies is perhaps even higher. Since many of these benefits are not tied to work/output, people have less reason to try and climb the ladder of opportunity.

Is this how a social safety net should work? Will such political discourse erode cultural attitudes surrounding “work ethic”? Has irreversible damage already been done?

This idea dovetails on the third category of common explanations: changes to attitudes wrought by the pandemic. One intriguing possibility is that the pandemic has made people value work less. The pandemic forced us all to take a hard look in the mirror and many surveys suggest that people now treasure time with family more than they once did. A shift in attitudes towards work is hard to pin down yet a recent study from Britain suggests that people want to work fewer hours even if their pay falls.

By making unemployment insurance schemes (entitlements) competitive with market wage rates in a pandemic, it would come as no surprise if attitudes surrounding work ethic have suffered. Rewards and incentives change habits and behaviour. The longer this dynamic persists, the longer and more difficult it will be to reshape such habits and adjust behaviours.

It is still too early to tell how much work ethic has suffered yet this potential conditioning accelerated by COVID-19 is not a positive development.

The economic carnage brought on by Covid-19 induced lockdowns necessitated extraordinary monetary and fiscal intervention. Politicians and Central bankers had to act. The problem we see today is that a potential pandora’s box of entitlement and complacency has been opened.

When leaders have simply to open the spigot to earn votes, there is little incentive to improve the quality of leadership. Hence, in our opinion, the disastrous state of leadership today.

Thomas Jefferson and Alexander Hamilton agreed on little publicly, but they did agree that when the public treasury becomes a public trough and voters take notice, they will send to government only those who promise them a bigger piece of the government pie.

There’s an old theory that wealthy democracies follow a socio-economic cycle from slavery to spiritual faith, to great courage, to liberty, to abundance and wealth, to complacency, to apathy, to dependence and back to slavery. Judging from the post Covid-19 socio-economic climate we appear to be on a problematic path to complacency and apathy.

When entitlement is not linked to output and contribution there is little willingness to accept responsibility for one’s own life - which is the source from which self-respect and thus character, springs. Instead, one develops the perception that the outcomes of one’s life are entirely out of one’s hands.

And to be without character is perhaps the worst fate of all.

Charts of the Month

Valuations are certainly in the upper band even when measured against the past 25 years, which has been a time filled with higher-than-average historical valuations. Here’s one that may surprise you though — this year we’ve actually seen multiples on the S&P 500 contract:

JP Morgan also broke out valuations and earnings by the top 10 stocks in the S&P (which also includes Berkshire Hathaway, Tesla, Nvidia, JP Morgan and Johnson & Johnson) and everything else:

The top 10 stocks are now close to 30% of the market. This sounds concerning until you see they contributed 34% of the earnings over the past year. These companies are large for a reason.

They’re also expensive for a reason. You can see once you take away the top 10 holdings, the valuation of the other 490 or so stocks doesn’t look all that bad.

Logos LP July 2021 Performance

July 2021 Return: -1.18%

2021 YTD (July) Return: 7.28%

Trailing Twelve Month Return: 41.47%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: 24.39%

Thought of the Month

“Enough of this miserable, whining life. Stop monkeying around! Why are you troubled? What’s new here? What’s so confounding? The one responsible? Take a good look. Or just the matter itself? Then look at that. There’s nothing else to look at. And as far as the gods go, by now you could try being more straightforward and kind. It’s the same, whether you’ve examined these things for a hundred years or three.” - Marcus Aurelius

Logos LP Services

Looking for proprietary research? We would be happy to chat. Please book an intro call here.

Articles and Ideas of Interest

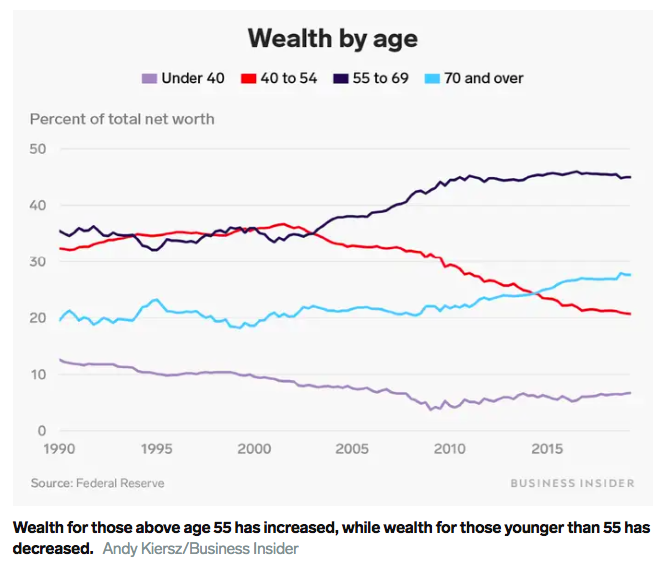

Florida is America's Future: Old, Southern and Retired. Why we should be concerned that the fastest-growing cities in the U.S. are retirement villages in the South. One of the most important trends to emerge from the 2020 Census didn't get much attention last week, but it reveals more about how both the U.S. economy and its politics will look in the coming years than most other details focused on by the news media. Americans' vision of their city of the future typically involves skyscrapers populated by large new technology companies. Yet the 2020 Census didn't point to San Francisco or New York as the fastest-growing city, or even one of the dozens of smaller metros that emulate them. The fastest growing metro area in the U.S. is the Villages, a retirement community in central Florida. And that's indicative of an economy that's older, less dynamic and more reliant on government benefits. It also points to a growing concentration of political and economic power in the south. Why is no one talking about this?

The Opposite of Toxic Positivity. Countless books have been written on the “power of gratitude” and the importance of counting your blessings, but that sentiment may feel like cold comfort during the coronavirus pandemic, when blessings have often seemed scant. Refusing to look at life’s darkness and avoiding uncomfortable experiences can be detrimental to mental health. This “toxic positivity” is ultimately a denial of reality. Telling someone to “stay positive” in the middle of a global crisis is missing out on an opportunity for growth, not to mention likely to backfire and only make them feel worse. As the gratitude researcher Robert Emmons of UC Davis writes, “To deny that life has its share of disappointments, frustrations, losses, hurts, setbacks, and sadness would be unrealistic and untenable. Life is suffering. Scott Barry Kaufman for The Atlantic suggests that no amount of positive thinking exercises will change this truth.

The Coronavirus Is Here Forever. This Is How We Live With It. Sarah Zhang for the Atlantic suggests that we can’t avoid the virus for the rest of our lives but we can minimize its impact. The current spikes in cases and deaths are the result of a novel coronavirus meeting naive immune systems. When enough people have gained some immunity through either vaccination or infection—preferably vaccination—the coronavirus will transition to what epidemiologists call “endemic.” It won’t be eliminated, but it won’t upend our lives anymore. Politicians crafting policy based on “Covid zero” are going down a dangerous path…

Warren Buffett’s Cash Trap Can Snare Big Tech, Too. The Berkshire Hathaway CEO has more cash than he knows what to do with. But Apple, Amazon and other tech giants face a similar dilemma. It may remain one of Buffett’s most memorable lessons. Even as tech company after tech company has joined the $1 trillion and then $2 trillion market-cap club during the pandemic, they all have something in common with Buffett: more cash than they know what to do with. It’s a good problem to have until it isn’t.

Companies and Families Are Loading Up on Debt. It Could Be a Dangerous Trend. For folks with finances stretched by inflation, using “buy now, pay later” (BNPL) to help pay for luxuries or even necessities, such as an updated wardrobe to return to work, might be the clincher in the purchasing decision. Square’s ability to provide ready funding to merchants and consumers apparently justifies the $29 billion price tag for Afterpay—equal to an enterprise value of 35 times gross profit for the next 12 months, according to MoffettNathanson analyst Lisa Ellis. But it belies the notion of flush consumers. Or does it?

Why Managers Fear a Remote-Work Future. Interesting take on remote work by Ed Zitron in the Atlantic suggesting that like it or not, the way we work has already evolved. Remote work lays bare many brutal inefficiencies and problems that executives don’t want to deal with because they reflect poorly on leaders and those they’ve hired. Remote work empowers those who produce and disempowers those who have succeeded by being excellent diplomats and poor workers, along with those who have succeeded by always finding someone to blame for their failures. It removes the ability to seem productive (by sitting at your desk looking stressed or always being on the phone), and also, crucially, may reveal how many bosses and managers simply don’t contribute to the bottom line.

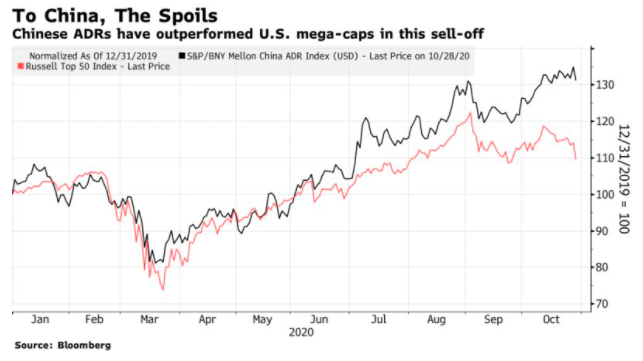

Why is China smashing its tech industry? Noah Smith suggests that it has something to do with what countries consider to be the “Tech Industry”. China may simply see things differently. It’s possible that the Chinese government has decided that the profits of companies like Alibaba and Tencent come more from rents than from actual value added — that they’re simply squatting on unproductive digital land, by exploiting first-mover advantage to capture strong network effects, or that the IP system is biased to favor these companies, or something like that. There are certainly those in America who believe that Facebook and Google produce little of value relative to the profit they rake in; maybe China’s leaders, for reasons that will remain forever opaque to us, have simply reached the same conclusion.

What’s Holding Back China’s Recovery? The Kids Aren’t Alright. There are many answers, but one important piece of the puzzle is starting to become clear: Young workers and job seekers, who often spend more of their income since they are just starting out, are struggling. Until that is rectified, regaining China’s pre-pandemic consumption-growth trend could be challenging. Online movements springing from youth discontent such as “tang ping” or “lying flat,” which was started by a disenchanted former factory employee and rejects overwork, may be difficult to fully suppress. This problem is affecting most nations globally as policy makers ignore the plight of the next generation…

America’s Investing Boom Goes Far Beyond Reddit Bros. Robinhood traders have earned the most attention, but they’re only part of a larger story about class stagnation and distrust. Fascinating account by Talmon Joseph Smith in the Atlantic of the investing craze that has characterized the post pandemic world. In a series of interviews conducted with economic analysts, amateur and professional investors, cryptocurrency lovers, and former hedge-fund managers, several people expressed the view that the subcultures born out of America’s untamed investing boom are many and varied. They’re diverse, if not integrated; some silly, some assiduous—yet all infused with a quiet desperation to reach escape velocity and defeat the gravitational pull of class stagnation that’s lasted decades...

Our best wishes for a month filled with joy and contentment,

Logos LP