Good Morning,

U.S. stocks finished slightly higher on Friday to set another round of record closes.

The major averages finished with modest gains for the week, as the strong rally which opened February has now taken a little breather.

The market ground higher to notch records this month as investors remained hopeful for a smooth economic reopening as well as additional Covid stimulus. The Dow has gained 4.9% in February, while the S&P 500 and the Nasdaq have rallied 5.9% and 7.8%, respectively. The S&P 500 has raked in ten record closes in 2021.

Cyclical sectors, those most sensitive to an economic rebound, led the rally in February. Energy is up more than 13% month to date, with financials and materials also among the leading sectors. Nevertheless, while the "other" segments of this market garner the attention, it is important to acknowledge that this is a very broad based rally.

Our Take

The medical and economic picture is improving and investors seem to be taking notice. Additionally, fourth-quarter earnings are rolling in well ahead of expectations, and analysts are now adjusting their 2021 earnings estimates upwards. Furthermore, if you take the time to look beyond the headlines - dominated by Reddit speculation stories (many of which have since sold off mercilessly) or “everything is a bubble” stories - investors have appeared to react rationally to underwhelming earnings prints from high-multiple “darling” stocks selling them off aggressively.

For all the unprecedented events and unforeseen consequences of the past year, all the fear mongering of bubbles and exuberance, market conditions today actually resemble quite closely to those of mid-February 2020, when stocks peaked right before the Covid crash. Interestingly, the S&P 500 (since its pre-Covid peak February 10, 2020) is only about 15% higher one year on. Is that euphoria?

Much of the discourse around the market is also similar; worries that too much of the market is dominated by a few large growth stocks (the top five S&P stocks were 20% of the index then and are 22% today) and that investor sentiment had grown complacent or even euphoric.

Back then, and like today, the S&P was at a 20-year high in terms of valuation, the forward price/earnings ratio then just above 19 and now surpassing 22 – yet for those who choose to compare equity earnings yields to Treasury yields, the gap is pretty close: 3.7 percentage points then versus 3.3 now.

Nevertheless, there are some key differences. The economic collapse brought on by government induced lockdowns reset the clock on the economic cycle and accompanying policy stances.

Michael Santoli reminds us that from 2019 into 2020 Wall Street was caught in a late-cycle set-up, with the economy near peak employment, the Treasury yield curve flat, corporate profit margins near peak, and earnings projected to be flat.

Short rates were higher at 1.5-1.75%, the Fed was on hold indefinitely yet certain Fed officials were projecting a rate hike in 2021.

The flash recession and profit collapse led to one of the greatest deficit-financed fiscal support binges in history ($5 trillion and counting) and turned the Fed maximum accommodative focused on a return to full employment coupled with a lasting rise in inflation before any whisper of normalization.

So, yes, valuations are higher now and investor expectations could be growing more willy nilly yet corporate America just refinanced itself for years to come at ultra low rates with a Fed and government who have gone all in on the “Wealth Effect”.

The "Wealth Effect" is the notion that when households become richer as a result of a rise in asset values, such as corporate stock prices or home values, they spend more and stimulate the broader economy.

Asset Price Increases = Spending Increases = Employment Increases

Now in 2021, earnings will be back above their prior peak, government is eager to run the economy hot and policy makers (arguably) just pulled off a repeatable process for sidestepping a recession.

For us, we do believe certain themes and stocks are running hot and that the major indexes look tired. As such, we maintain a focus on individual names. We expect divergences to emerge across sectors with higher volatility for the rest of the year. We see opportunities in individual small-caps particularly in names that are under-the-radar and still have long-runways and thus real value. Think bio-tech, health-tech, clean-tech and certain basic materials. We also like smaller emerging markets (Asia) that can benefit from a weaker U.S. dollar and still have upside to historical valuations.

Musings

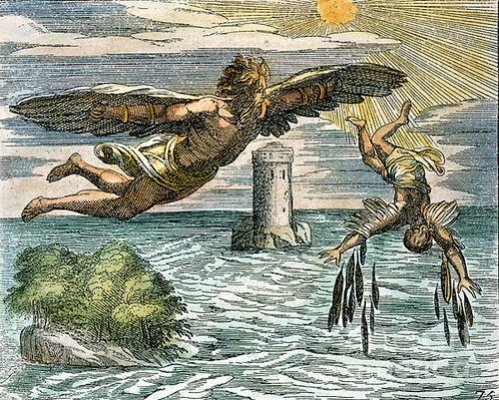

So are we in a "different " investment world today? Have the old rules changed? Or will all the “pundits” pointing to history (South Sea bubble, 1929, and 2000) calling for an epic crash be vindicated?

The short answer is they might, as the future is unknowable. Yet today we believe that one should be cautious when applying investment history to the present in order to predict the future.

The further back in investment history you go the more likely you are viewing a world that no longer applies to the present moment.

As Morgan Housel reminds us in his fabulous book, investment history matters, yet if one relies too heavily on it, one will likely miss the outlier events that have the greatest impact.

It is important to remember that most of what is happening at any given moment in the global economy can be linked to a handful of past events that were nearly impossible to predict.

Think: the invention of the printing press, the first passenger plane, penicillin, the integrated circuit, the internet, the Great Depression, WWII, September 11th and Covid-19 to name a few.

The most common denominator of economic history is the role of surprises. The danger investors face is taking the worst and best events of the past and assuming they will occur again in the future. They make the assumption that a history of unprecedented events doesn’t apply to the future. This isn’t a failure of analysis but a failure of the imagination.

Instead, we believe that the future might not look anything like the past and this need for imagination grounds our approach to investing. We understand that the things that will move the needle the most are the things history gives us no guide to understanding or necessarily predicting.

We also understand that history can be a misleading guide to the future of economies and stock markets as it has difficulty accounting for unique structural changes that are key to today’s world.

Historical theories about recessions, interest rates, inflation and purchasing stock often look tired when applied to today’s world. We take cues from the past, but believe in the power of adapting such learnings to the present.

Constant experimentation, retesting of assumptions and adaptation is crucial for lasting investment success. Tethering to past events, patterns and ideas can bring comfort but it can also lead to destructive blind spots.

Human nature and human behaviours tend to be stable over time, yet specific investment trends, causal relationships and strategies are constantly evolving.

Regardless of whether the pundits are at some point proven correct, those who can free their minds and evolve their ideas and biases tilt the odds of outperformance in their favour.

Charts of the Month

County-level data on U.S. stock market holdings suggest that rising share prices induce consumer spending, which raises employment and wages.

Cross-border investment fell off a cliff in 2020, dropping 42% to $859 billion from 2019's $1.5 trillion, according to official UN figures.

Logos LP January 2021 Performance

January 2021 Return: 11.71%

2021 YTD (January) Return: 11.71%

Trailing Twelve Month Return: 116.73%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: 27.10%

Thought of the Month

“In general I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook was first published. But the situation has changed a great deal since then.” -Benjamin Graham

Articles and Ideas of Interest

Why a dawn of technological optimism is breaking. The 2010s were marked by pessimism about innovation. The Economist suggests that is giving way to hope. For much of the past decade the pace of innovation underwhelmed many people—especially those miserable economists. Productivity growth was lacklustre and the most popular new inventions, the smartphone and social media, did not seem to help much. Their malign side-effects, such as the creation of powerful monopolies and the pollution of the public square, became painfully apparent. Promising technologies stalled, including self-driving cars, making Silicon Valley’s evangelists look naive. Security hawks warned that authoritarian China was racing past the West and some gloomy folk warned that the world was finally running out of useful ideas. Today a dawn of technological optimism is breaking. The speed at which covid-19 vaccines have been produced has made scientists household names. Prominent breakthroughs, a tech investment boom and the adoption of digital technologies during the pandemic are combining to raise hopes of a new era of progress: optimists giddily predict a “roaring Twenties”. Just as the pessimism of the 2010s was overdone—the decade saw many advances, such as in cancer treatment—so predictions of technological Utopia are overblown. But there is a realistic possibility of a new golden era of innovation that could lift living standards, especially if governments help new technologies to flourish. Opportunities abound. The future is bright.

Canadians’ wealth is tied to their parents’ more than ever, StatCan finds. A new study has found that the likelihood of Canadians staying within the same income and wealth class as their parents has increased significantly. The report, released Wednesday by Statistics Canada, measured the incomes of five different cohorts of children born between the 1960s and 1980s, as well as that of their parents. It found that intergenerational income mobility — the degree to which a person’s income and wealth could move further from that of their parents — had declined across all of the cohorts.

As Vaccines Raise Hope, Cold Reality Dawns: Covid-19 Is Likely Here to Stay. Governments and businesses are starting to accept that the coronavirus isn’t a temporary problem and instead will lead to long-term changes enabling society to co-exist with Covid-19, as it does with flu, measles and HIV.

'Alarming' numbers show Canadian business investment has plunged to just 58 cents for every dollar spent in the U.S. Canadian business investment numbers out today ‘tell a bleak story’ of a nation that will struggle to compete when it emerges from the COVID-19 pandemic. The pace of business investment’s decline over the past five years has been alarming, says the C.D. Howe Institute report, entitled “From the chronic to the acute: Canada’s investment crisis.” After “slipping badly” since 2015, it has now plunged in 2020 to the lowest since the beginning of the 1990s, widening the gap between us and the United States and other OECD countries.

While the world is in the midst of a tech revolution, Canadians (as usual) bet on real estate. Now, the addiction is simply embarrassing. The world is in the midst of a transformative shift to a digital and carbon-neutral economy, a once-in-a-lifetime investing opportunity, and where are Canadians placing their bets? Houses, for the most part. We’ve resumed, after a brief cooldown, plowing a ridiculous amount of money into assets that do nothing to improve the country’s ability to generate wealth. Housing accounted for 37 per cent of overall investment, while business spending on machinery and equipment and intellectual property dropped to 28.2 per cent, the highest and lowest levels, respectively, since early 1993.

GameStop may not have been the retail trader rebellion it was perceived to be. The prevailing narrative of a retail investor revolution or a David vs. Goliath battle seems flawed. Data shows institutional investors as drivers of a large portion of the wild price action in GameStop. GameStop was not even in the 10 most-bought names by retail investors that month, according to JPMorgan.

Markets that are definitely NOT in a bubble. If it feels like we’ve been debating a stock market bubble in the U.S. for a decade it’s because we have. LOL Ben Carlson suggests that the longer this goes the louder the chorus of bubble-callers will get. And maybe they’ll be right eventually. Bubbles are basically an American past-time. We can debate all we want about whether we’re in a bubble or not and there are compelling arguments on each side. But there are plenty of other markets that are certainly not in a bubble. Ben puts together a compelling list. Emerging markets representing the most interesting opportunity.

SPACs are red-hot—but they’ve been a lousy deal for investors. For the dealmakers who put SPACs together, the upsides are obvious. For investors, not so much. For the dealmakers who put SPACs together, the upsides are obvious. They can skip the headache of a road show—in which a company’s top executives make the same pre-IPO presentation over and over to would-be investors—as well as avoid the customary 7% fee normally paid to underwriters. Meanwhile, the organizers typically pocket 20% of the SPACs, a reward known as the “sponsor promote” for their trouble. In other words, the SPAC has plenty of upside and almost no downside. Well, no downside for the SPAC organizers that is. For ordinary investors, though, SPACs have often proved to be a rotten deal. For 107 SPACs that have purchased companies since 2015, the average return on common stock has been a putrid negative 1.4%. That compares with a 49% return for companies that went public via the traditional IPO route during the same period, according to data cited by the Wall Street Journal.

Tom Lee says rising retail interest won’t mark a market top, could be the start of a long-term trend. The previous decade has been characterized by large inflows in bonds despite the bull market in stocks. This could be the first year out of ten years where there’s real inflows into stocks.

Social-Media algorithms rule how we see the world. Good luck trying to stop them. What you see in your feeds isn’t up to you. What’s at stake is no longer just missing a birthday. It’s your sanity—and world peace. Fascinating article in the WSJ outlining how computers are in charge of what we see and they’re operating without transparency.

The battery is ready to power the world. After a decade of rapidly falling costs, the rechargeable lithium-ion battery is poised to disrupt industries. The WSJ digs in. We like MP Materials as a long term benefactor of this disruption.

Our best wishes for a month filled with joy and contentment,

Logos LP