Good Morning,

The Dow Jones Industrial Average jumped to another record high on Friday as reopening optimism continued to encourage the rotation into cyclical stocks. Meanwhile, surging bond yields rekindled valuation fears and took the comeback momentum out of high-growth, high multiple names.

The 10-year Treasury yield jumped another 10 basis points to 1.64% at its session high Friday, hitting its highest level since February 2020. The benchmark rate started 2021 at around 0.92%.

The rapid rise in bond yields prompted investors to dump the high-growth, high-multiple long-duration Nasdaq (QQQ) names again after a brief rebound earlier this week. Sharp increases in interest rates can put outsized pressure on such high-growth long-duration stocks as they reduce the relative value of future profits.

February and March saw the biggest market sell-off since September 2020. The recent sell-off predominantly affected the QQQ with a rotation out of high-growth, high-multiple technology companies and into businesses that have taken a beating throughout the pandemic (energy, banks, live events, brick-and-mortar retailers, hotels or travel to name a few).

For those in more traditional S&P 500 (SPY) components, with little exposure to the high-growth complex, the “sell-off” was barely noticeable. Whereas, for those with significant exposure to such long duration assets, the drawdown was more pronounced than the move in the index would suggest, with many names reaching extremely oversold levels (average drawdowns of 30%-40% across the board):

Many analysts and so-called market pundits have since rushed in and declared that the bubble is popping. That the high-growth technology trade is dead. The refrain is now:

“I think the story is becoming very, very clear in the tech sector. We have incredibly high valuations and yields that have tripled from the low last year,” said Robert Conzo, CEO of The Wealth Alliance. “You are going to see a lot of volatility in the tech sector. There’s a better trade out there in the cyclicals.”

Or even more bold calls such as:

“2020 marked the secular low point for inflation and interest rates; new central bank mandates, excess fiscal stimulus including UBI, less globalization, fading deflation from disruption, demographics, debt…we believe inflation rises in the 2020s and the 40-year bull market in bonds is over… BofA Global Research’s Inflation Survey shows 61% of analysts saw their companies raise prices in recent months. AA [asset allocation] implications bullish real assets, commodities, volatility, small cap value, and bearish bonds, US$, large cap growth.”

There is no doubt that the rapid sharp increase in U.S. government-bond yields is pressuring certain pockets of the stock market and forcing investors to confront the implications of both rising inflation and interest rates.

Yet the rotation referenced above has been playing out for at least 6 months now as energy, financials, industrials and materials (stocks whose fortunes are closely tied to economic growth) have greatly outperformed technology:

Same goes for growth vs. value with traditional value stocks (those which trade at low multiples of their book value, or net worth) beating growth stocks by the widest margin in TWO DECADES!

This year, the Russell 1000 Value Index is up 11% and the Russell 1000 Growth Index has edged up 0.2%.

That gap is the largest lead for value stocks at this time of year since 2001, according to Dow Jones Market Data, when the bursting of the tech bubble led to a resurgence in value shares. At this point last year, during the coronavirus-induced downturn, growth stocks held a wide lead.

Oh what a difference a few months can make...

Our Take

So, should one abandon high-growth technology/innovation and chase the hot hand, piling into cyclicals/value names even as they reach new highs? Should one chase the trend and shift to low quality, high volatility, weak balance sheet names with little profitability?

What should we make of the rotation?

Value investing and growth investing are two different investing styles.Traditionally, value stocks are thought of as an opportunity to buy shares below their actual value (although most investing can be conceptualized this way), and growth stocks exhibit above-average revenue and earnings growth potential.

Wall Street attempts to categorize stocks neatly as either growth or value stocks. The truth is a bit more complicated, as some stocks have elements of both value and growth. Nevertheless, to answer the questions posed above, it is important to step back and think about what’s going on and how investors should approach the current market.

The pandemic has caused a massive acceleration for digital/innovation businesses. This isn’t likely to be temporary. The pandemic has now lasted long enough for consumers and companies to form new habits and ways of doing business, many of which will last even as the pandemic fades into history.

The digital/innovation acceleration is real. The long-term implications are likely larger than currently envisioned by even the most optimistic forecasters. Yet as we have warned before, many stocks leveraged to these trends, especially those that appear to be pure plays, were likely overvalued coming into 2021 and remain overvalued now. Mistaking such individual investments as a "no-brainer" way to capture long-term mega trends like digital acceleration, AI, solar, cloud, blockchain, EV is fraught with risk as stock price moves in such names can be extreme.

At a high level, as long-term investors (more on this below), we believe that although the declines discussed above can be painful given their speed and unpredictability, investors must be willing to pay this price in the pursuit of above-average long-term returns.

Such drawdowns should not be a catalyst for panicked portfolio rebalancing, as well as significant rotations/reallocations towards the “investment theme du jour”. Instead, they should prompt diligent reflection on one’s portfolio:

How do I understand market, sector and company risk?

How much drawdown can I cope with?

Do I have the cash I need and a cash deployment strategy?

Does my portfolio fit my risk profile?

Do I have a list of stocks I want to buy and a strategy for allocating to them?

Do I have a strategy that is written down?

In addition to this, the recent drawdowns in high-growth/high-innovation names should remind us that it isn’t enough to recognize a big innovation/investment trend and throw money at it.

As QQQ names were melting down earlier this month, there was real fear that this could be a Dot Com moment. The knife could continue to fall.

Intrinsic Investing reminds us that if we look at the Dot Com crash for guidance we can find at least two important lessons: 1) people at the time were too conservative about their big mega trend outlooks and; 2) they were too optimistic in how they expressed those views in individual stock selection.

Despite the internet being vast, only a handful of the companies capitalized on the mega trends of the times. Some of the biggest winners of the internet age weren’t even public (i.e. Google) or founded yet (i.e. Facebook) until well after the Dot Com bubble crashed.

The Dot Com bubble and crash teaches us not to get out of the market when speculative activity surges as it is today. Rather, the takeaway is to “avoid those specific stocks that are speculatively valued and to be highly skeptical of unproven businesses that claim they are sure to capitalize on exciting new trends.” It is during periods like these - and where we find ourselves today - that stock selection (knowing what you own) becomes extremely important. The last few weeks have been a stark reminder of this principle.

So, as we manage our portfolio at a time when speculative activity is rampant, we will do our best to keep an open mind when it comes to the significance of the big fundamental changes at play, while remaining very skeptical about which companies will capture those trends and the valuation of those companies we believe will be the long-term winners. In short, we will not be rotating into low quality, high volatility, weak balance sheet names with little profitability.

Musings

It’s important to realize that as an investor in an increasingly digital world in which investment information is ubiquitous, no matter what innovations we see in the financial industry, patience will always be the great equalizer in the financial markets. In fact, one of the biggest advantages investors have over the pros and even the machines is the ability to be patient.

Charlie Munger nailed it when he remarked:

“We've really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money's been made in the high quality businesses. And most of the other people who've made a lot of money have done so in high quality businesses.

Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.”

Individual investors have the luxury of thinking (and hopefully acting) in terms of decades which is virtually impossible on Wall Street. A buy and hold strategy is by no means perfect, yet for it to work, you need to do both the buying and the holding during a drawdown. Of late, it has been much easier to do the buying and holding when markets are rising. Yet we must remember that on the journey to making large returns, there will be detours accompanied by poor returns.

For example, Morgan Housel looked at one of the best-performing stocks of the last 20 years (Monster Beverage) and found that it spent the majority of that time with returns that would make make most investors hit the sell button.

Housel looked at the 10 best stocks to own over the past 20 years which were all cherry-picked for their stellar returns, and would represent the stocks you would probably choose to own if you had a time machine. On average they increased more than 28,000%.

But they all spent a majority of the time well below their previous high mark. They all had multiple declines of 50% or more. A few had multiple 70% drops.

Investors underestimate how common and severe volatility is, especially among individual stocks. If stocks with the cherry-picked best returns spend a third of their time down at least 30%, you can imagine what the long-term losers look like.

In 2009, Charlie Munger was asked how concerned he was that Berkshire Hathaway shares — which made up most of his net worth — dropped more than 50%. He quickly interrupted the interviewer and responded:

“Zero. This is the third time that Warren [Buffett] and I have seen our holdings in Berkshire Hathaway go down, top tick to bottom tick, by 50%. I think it's in the nature of long-term shareholding that the normal vicissitudes in markets means that the long-term holder has the quoted value of his stocks go down by, say, 50%.

In fact, you can argue that if you're not willing to react with equanimity to a market price decline of 50% two or three times a century you're not fit to be a common shareholder, and you deserve the mediocre result you're going to get compared to the people who can be more philosophical about these market fluctuations.”

Investing is work. Stock picking is work. There are no shortcuts that provide easy money for an extended period of time.

For long-term investors like us, there is no scenario where we will be meaningfully selling out of high quality businesses in order to buy and hold low-quality businesses or sit in cash. Why not now?

We don’t know how to time the market: We don't know when the market will crash or even correct. It could be next week; it could be a decade from now. Unpredictable geopolitical, environmental, and biological events, coupled with people's emotional response to them, will determine this.

What matters is time in the markets: If you wait for ideal conditions before investing, you never will. Time in the market is what is important. Productively and diligently allocating capital creates far more wealth than timing its allocation perfectly.

Stocks are a wonderful hedge against inflation: Since 1928, the U.S. stock market is up 9.8% per year while inflation has averaged 3% per year. So stocks have grown at nearly 7% more than the rate of inflation. One of the reasons for this is the fact that earnings and dividends also grow at a healthy clip above inflation. Over the past 93 years, earnings have grown at roughly 5% per year. Stocks also have perhaps the greatest income stream of any asset. Dividends have grown at roughly 5% per year. So earnings and dividends both have a history of growing above the rate of inflation.

Real interest rates are likely to remain negative over the long term: We aren’t economists, yet we believe that the rise in inflation and interest rates will be a temporary diversion from a clear downward trend. The fiscal stimulus is all transitory and the economic effects on demand will be short-lived. Zombie firms (those that cannot cover their fixed expenses with operating income and thus continuously rely on the capital markets to survive) are proliferating all over the developed world causing disinflation. We are also going through a productivity boost (technology) at a time when real wage growth is depressed and that is no prescription for durable inflation from a unit-labour cost perspective. In addition, aging demographics and a catastrophic collapse in birth rate (which no one is talking about) across the developed world are disinflationary, while governments are arguably the most anti free-market and least business friendly ever. How will the investor holding a portfolio of low quality, high volatility, weak balance sheet names with little profitability fare if the reflation thesis flames out?

There will always be another narrative to worry about. A reason to sell your holdings or rotate into the “investment theme du jour”. A good long-term investment strategy will not produce desired returns year in and year out.

Rather, it will be tested as it makes progress toward some long-term goal over time as winning years more than offset losing years. Investors who keep their investment strategy consistent regardless of volatility set themselves up for success over the long-term.

Embrace the grind. How can you know what your investment strategy is made of if its never been tested?

Charts of the Month

How does the market perform when interest rates rise?

Back drop: Why the big picture is critical – especially now:

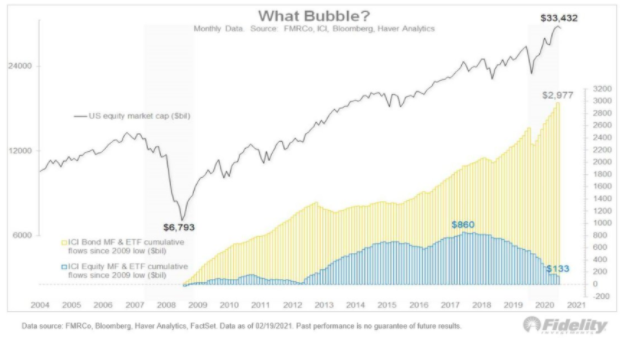

(1) Three YEARS of non-stop Stock selling.

(2) All the money went into Bonds.

If the rally continues, where does the money go? Is the current equities market a bubble? This chart offers some perspective. Look at where money has been invested since the March 2009 bottom. The bets on equity funds and ETFs are dwarfed by the inflow for bonds.

Where are the jobs? Where is the growth?

The big boost China experienced post Covid-19 looks like it has already come to an end. China's economy was the first to recover from the Covid-19 collapse due to trillions of credit pumped into the economy at home, as well as Americans rushing out to buy imported goods using stimulus money. With China again showing signs of economic weakness, the story that it takes more and more stimulus to create the same kick each time we play this game is playing out. Will the story somehow be different for America or Canada?

Zombies are taking over the world.

If you think that is a lot, consider the entire globe. An International Monetary Fund report from October 2019, fretted that global zombie debt could soon rise to $19 trillion and amount to 40% of all corporate debt in major economies...

Logos LP February 2021 Performance

February 2021 Return: 2.89%

2021 YTD (February) Return: 14.95%

Trailing Twelve Month Return: 133%

Compound Annual Growth Rate (CAGR) since inception March 26, 2014: 27.29%

Thought of the Month

“I judge you unfortunate because you have never lived through misfortune. You have passed through life without an opponent- no one can ever know what you are capable of, not even you.” -Seneca

Logos LP Services

Looking for help with your investments? Unsure about how to achieve your financial goals? We would be happy to chat. Please book an intro call here.

Articles and Ideas of Interest

The Gig Economy Is Coming for Millions of American Jobs. California’s vote to classify Uber and Lyft drivers as contractors has emboldened other employers to eliminate salaried positions—and has become a cornerstone of bigger plans to “Uberize” the U.S. workforce. This while Long-term unemployment is close to a Great Recession record and the unemployment rate for the bottom quartile of Americans is 23%.

Canada's balance sheet is deteriorating and the consequences could be significant for investors. Canada is spending in places that may not directly repair the damage that has been done by the virus. No wonder a job in the public sector has never looked better. The long-running rivalry between the two services — public versus private — has been settled by COVID-19. Why would anyone risk the dangers and uncertainty of free enterprise when they could have the safety and security of a large and ever-expanding government? The bottom line is that the cachet that once went with private employment has gone the way of the Dodo bird, which coincidentally never had a government to protect it either. Public pay is better, the benefits top-of-line, it’s almost impossible to be fired, you know the date you can retire, and the amount you’ll be paid. If you don’t get along with your manager you can call the union and grieve 13 ways from Sunday. You don’t have to worry about the business going under, and can live in confidence that terror-stricken politicians will opt to buy peace at contract time, rather than challenge the latest set of demands. This reality is a major problem for the future of Canada’s economy.

Move over GameStop, hockey cards are emerging as the hottest bull market on the planet: Blame it on the pandemic, but cards are seeing a 'parabolic boom' with values up 300% to 400%. All this while people are paying millions for video clips that can be viewed for free. Welcome to the world of ‘NFTs’.

Microdosing study shows placebo effect of taking psychedelics. UK research into LSD consumption reveals expectation of improved wellbeing drives transformation rather than the drug itself. The mind is more powerful than the sword.

YOLO investing still appears healthy. 37% of Americans in a recent online survey say they've made trades based on an Elon Musk tweet and half of respondents in a recent survey between 25 and 34 years old plan to spend 50% of their stimulus payments on stocks. Bless their hearts.

The long-term economic costs of lost schooling. Students who are falling behind now because of Covid restrictions may never catch up in their skills, job prospects and income.

SPACs are becoming less of a sure thing as the deals get stranger, shares roll over. Faced with intense competition, deadline pressure and a volatile market, some SPACs had to settle for less ideal targets, and in some cases, throw their entire blueprint out the window.The proprietary CNBC SPAC 50 index, which tracks the 50 largest U.S.-based pre-merger blank-check deals by market cap, dropped more than 15% in the past two weeks, giving up all of its 2021 gains. Most are problematic, but there is one we find attractive: IonQ (DMYI) which promises to be the leader in quantum computing.

What happened to gold? If you went into a laboratory to build a gold price optimizer, you would want a couple of things: A falling dollar, Rising inflation expectations, Money printing, Central bank balance sheets expanding, Fiscal deficits increasing and Political turmoil. All of these things were in place over the last few months, and yet gold has done the opposite of what you expected it to do. It’s down 9% over the last 6 months, and it’s 15% below its highs in August. Gold could rally on any one of the items I mentioned. All six were in place at the same time, and it couldn’t get out of its own way. Michael Batnick digs in.

How Much Longer Can This Era Of Political Gridlock Last? Democrats may have a narrow majority in both the House and the Senate for the next two years, but it’s nothing near the margin they hoped for. And the likelihood that Democrats keep both the House and the Senate in 2022 are low, as the president’s party almost always loses seats in the midterm elections. That means more divided government is probably imminent, and the electoral pattern we’ve become all too familiar with — a pendulum swinging back and forth between unified control of government and divided government — is doomed to repeat, with increasingly dangerous consequences for our democracy.

Our best wishes for a month filled with joy and contentment,

Logos LP