Good Morning,

Stocks closed mostly flat on Friday amid a strong dollar and as earnings season continued.

The S&P 500 ended around breakeven after holding lower for most of the session, with consumer discretionary leading advancers. Consumer discretionary stocks were led by Time Warner, which rose more than 7 percent amid reports the firm has engaged in talks for a deal to be bought out by AT&T, which dragged the telecommunications sector lower.

So far Q3 earnings have been pretty good according to data compiled by The Earnings Scout, 80 percent of the 116 S&P components that had reported as of Friday morning had beaten Wall Street's earnings estimates, while 65 percent had beaten revenue estimates. This week also saw encouraging beats from Microsoft, Netflix and MacDonald’s in addition to a juicy bid announced by British American Tobacco to acquire one of Logos LP’s holdings Reynolds American (RAI). Look for strength next week as Apple, Amazon and Google report.

Our Take: The investment mood is still downright miserable. Hedge funds are bleeding money, closing up shop and complaining that: “There’s gloom everywhere,” or that the financial crisis “was a sudden death for a lot of people, like a heart attack, but this feels like cancer to many people, a slow death.” Or that “There was a playbook based on logic that worked most of the time before 2008...But the game has changed and logical investors haven’t got the new playbook figured out yet.”

The International Monetary Fund chief economist Maurice Obstfeld said in October, while presenting the fund’s 2017 outlook, that “taken as a whole, the world economy is moving sideways” with other pundits stating that: “The crisis has left a cocktail of interacting legacies—high debt overhangs, nonperforming loans on banks’ books, deflationary pressures, low investment, and eroded human capital—that continue to depress potential investment levels.”

Furthermore next year ends in a 7. If you’re superstitious or a little loose with statistics, that makes us due for another financial crisis. The biggest one-day stock drop in Wall Street history happened in 1987. The Asian crisis was in 1997. And the worst global meltdown since the Great Depression got rolling in 2007 with the failure of mortgage lenders Northern Rock in the U.K. and New Century Financial in the U.S.

And if that wasn’t bad enough, calls for a correction in Silicon Valley are multiplying. Bloomberg reports that “things were different in Silicon Valley in the distant year of 2012, when iPhone sales were skyrocketing and you could still buy a house in Palo Alto for less than $2 million. Back then, most restaurants had menus, not tasting menus. Chief executive officers could say something grandiose at a tech conference without worrying about getting mocked on HBO six months later by the Beavis and Butt-head guy. And a talented entrepreneur could walk into a venture capitalist’s office, say his startup was a mobile-first solution for pretty much any problem (payments! photos! blogging!), and walk out with a good-size seed investment. “That pitch was enough to get going,” says Roelof Botha, a partner with VC firm Sequoia Capital. “It’s not enough anymore.””

Well from where I’m sitting things aren’t that bad. There are still plenty of ways to outperform the market if one is patient and thoughtful in their approach. (We would be happy to show you how we do it.)

Furthermore, as I’ve stated before being bearish costs nothing and quite frankly is a healthy sign of a market that hasn’t yet peaked. The most likely scenario is a sideways market in which returns will be more difficult to come by but this is how systems work. Reset expectations and take a close look at what the market is now offering you.

There are still many individual businesses that are generating immense shareholder value growing their top and bottom lines. Instead of “whining” about a “rigged system” or “unconventional central banks” or a “climate you don’t understand” or “no longer recognize,” enjoy the challenge. Relish in it. It is through adversity that growth occurs. Life like investing is in many ways simple. But never easy….

Thought of the Week

"Times of transition are strenuous, but I love them. They are an opportunity to purge, rethink priorities, and be intentional about new habits. We can make our new normal any way we want.” –Kristin Armstrong

Stories and Ideas of Interest

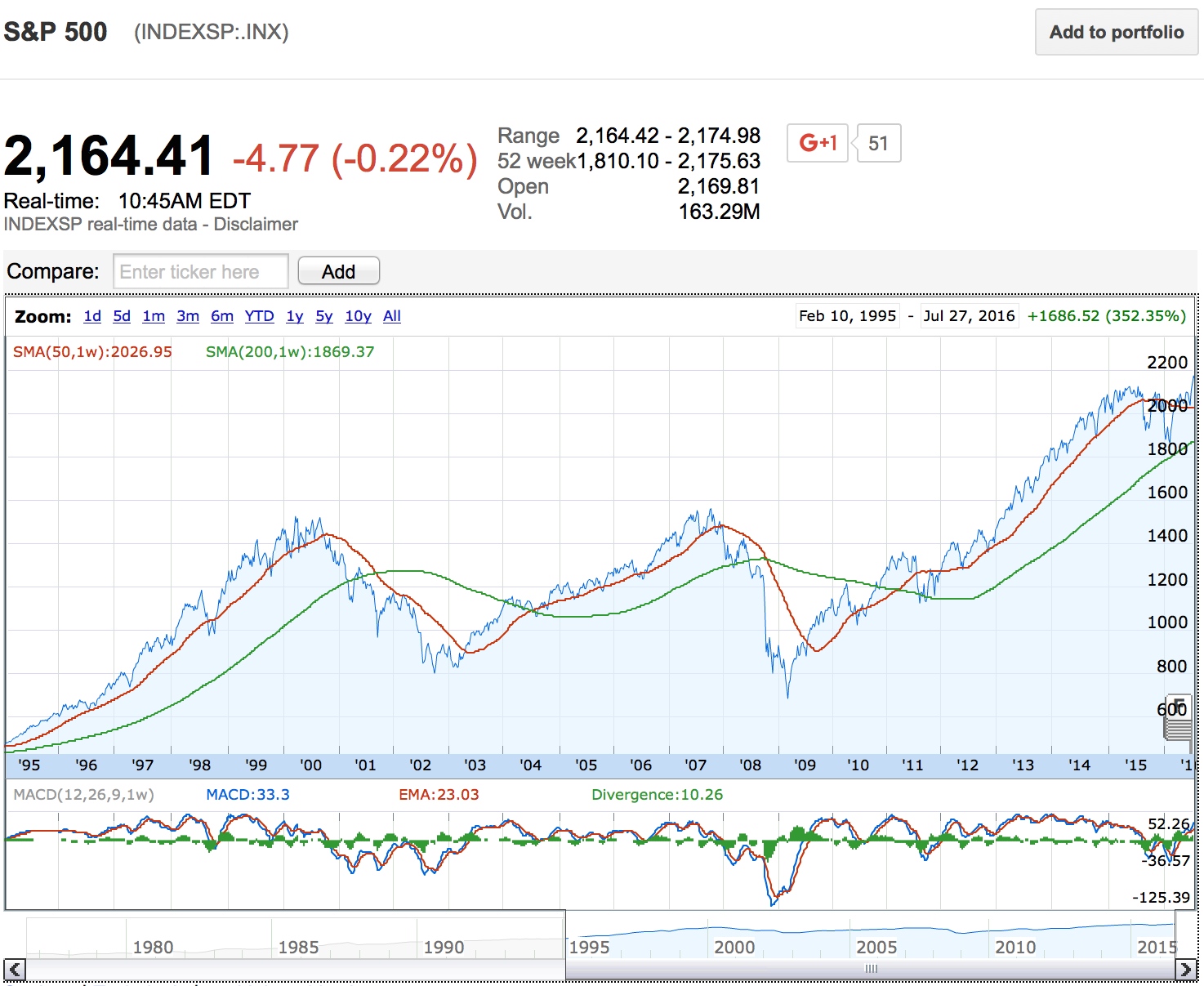

- A visual history of US elections and global markets suggests business as usual. A few weeks ago I addressed the question of whether a Trump victory would send the markets into a tailspin. My answer was that a win by either candidate would most likely have very little impact. Chris Groskopf and David Yanofsky, after charting changes of power in the White House going back to 1992, show that market reactions to new presidents are generally a great big “meh.” Ignore the noise.

- The real danger of Donald Trump’s conspiracy theories. The Republican nominee is whipping up his supporters into a state of paranoia, convincing them that the election will be rigged and everyone is against them. To prevent violence, Sarah Kendzior argues, Trump’s critics—especially Republican ones—should stop pressuring him to drop out; it just gives him ammunition. Furthermore, the claims are unfounded. “It is more likely that an individual will be struck by lightning than that he will impersonate another voter at the polls,” said a 2007 report from the New York University School of Law’s Brennan Center for Justice that the center has been referencing in light of Trump’s claims.

- An alternative way to cope with failure. At present there is a craze for celebrating failure in entrepreneurial culture. The problem is that it is confined to those who’ve eventually made it big. What about those who haven’t? Bene Cipolla argues for a new way of confronting failure: accept it. Bask in it as it can be life giving.

- The smart money suggests that Italy will leave the EU. The country’s outflows are accelerating - up €118 billion ($130 billion) from just a year ago. No I suppose we haven’t seen the last of troubles originating in the EU….

- We need to plan for a future without jobs. Very interesting article in Vox from Andy Stern former president of the Service Employees International Union (SEIU), which today represents close to 2 million workers in the United States and Canada. A Universal Basic Income is coming…..Consider the types of businesses on Forbes’ list of 25 Next Billion Dollar Start-Ups….Lots of “productive” software offerings…. What are you worth anyway? Career website Glassdoor Inc. is releasing a new tool aiming to help employees find out if what they are earning is fair based on their location, employer, job title, years of experience, and education. Is it a cruel world that our efforts have been reduced to each worker having a simple fair “market value”? Or is this a helpful tool?

- Toronto real estate looks set to slow down. Evan Siddal CEO of the CMHC raised a red flag this week and stated in relation to the new real estate measures: “If people can just save a bit more money and have a bit more equity in their homes, that would be safer,” Mr. Siddall said. “A 5-per-cent down payment means you don’t have a lot of cushion on the downside.” Yet he states that there may be unintended consequences. Luckily Toronto Life Magazine looks into their crystal ball and finds that the average home in Toronto in 50 years will be 4.4 MILLION….(average price now is $620 000 which represents 7% CAGR over next 50 years. A lot can happen in 3 years let alone 50…)

All the best for a productive week,

Logos LP