Good Morning,

U.S. stocks closed slightly lower Friday, with financials lagging, following some renewed concern of geopolitical tension.

Reuters reported in late morning trade that a Chinese Navy warship has seized an underwater drone deployed by an American oceanographic vessel in international waters in the South China Sea, triggering a formal diplomatic protest from the United States and a demand for its return, a U.S. defense official told the newswire.

Our Take

We talked a bit about Grey swan risks last week. With U.S./China relations in a bit of slump since Trump was elected, it is worth remembering that life, like markets operates in cycles. If you find yourself in a high, begin preparing yourself for the next low. Without fail it is coming.

Nevertheless, this rally is tough to short. Investors are facing a swift transition to an activist and all-business American government. Trump has kept his cards close to his chest but the new strategy is set with a firm focus on jobs, incomes, infrastructure, and a desire to put an end to humiliating declines in the quality of American education and healthcare.

As Dr. Michael Ivanovitch for CNBC has stated: “These are the things that markets are betting on. Rest assured that Mr. Trump and his Wall Street appointees fully understand the conditionality of that welcome mat.”

Musings

As we prepare our best ideas and outlook for 2017 we came across this interesting long opportunity in Europe:

CRH PLC (ADR): Although industrials and construction have been the story in North America of late, could there be opportunity in Europe? In this name we see strength in construction materials, concrete and plumbing units. This company experienced rapid growth in 2015 and is trading at nearly 16.5 times forward earnings, only 1x sales and 2x book value. The company is in a cyclical industry yet has managed to growth revenue by 50% since 2006 and during the bull run of 2006-2008 saw a revenue increase of over 11%. Interestingly, the company generates more revenue and profit today but is trading below its 2006 levels and has a low price to cash flow ratio of 10x. Look for a dip below $30 as a good entry point. As for the macro infrastructure tailwind, we believe it has about 3 good years to play out before the sector reaches fair value.

Thought of the Week

"What was scattered gathers. What was gathered blows away." -Heraclitus

Stories and Ideas of Interest

Contrarian indicator? Could hoarding be a sign of a healthy economy? The boom in self-storage units suggests Americans are buying more than ever.

- Trump’s cabinet picks have more money than a third of all Americans combined. The most affluent cabinet ever boasts $9.5 billion in total wealth. This is actually incredible. Talk about flair…

- Sometimes disruption is staring you right in the face and you can’t help but look the other way. That’s doubly true when you’re the head of a legacy business desperate to stay relevant. Small players have historically changed the business landscape when the older guys aren’t aware enough or nimble enough to respond. Cb Insights puts together some great examples of big CEOs and executives who minimized disruptive threats when they appeared. When asked about these smaller players at the time (and even now) some companies have remained woefully dismissive.

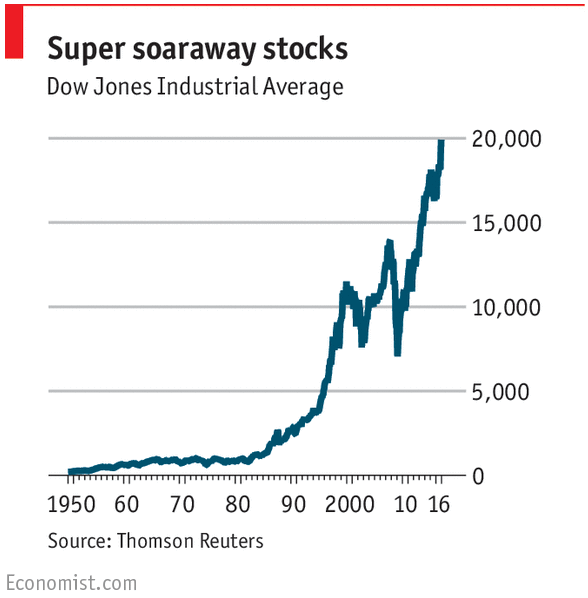

- Excuses Excuses. Or realism at work? America’s largest pension fund: A 7.5% annual return is no longer realistic. Probably smart to temper expectations...Although stocks do tend to rise....

- Investing is maybe 60% science, the rest art. Yes, it has numbers and formulas and rules. But the soft stuff you can’t measure or hardly even describe – the art of the business – makes all the difference in the world. Building a valuation model is a science. Calibrating it to reflect the psychology of uncertainty is an art. Morgan Housel offers an interesting look at the art of investing.

All the best for a productive week,

Logos LP