Good Morning,

Last week U.S. stocks posted their first 2-week losing streak as the Treasury yield curve flattened further, raising concerns about economic growth while worries about tax reform percolated. The dollar dropped as the yen and gold gained.

The spread between two- and 10-year Treasury yields hit the tightest level in a decade. The greenback remained linked to political developments in Washington, where the Senate girded for negotiations on its version of tax reform.

Elsewhere, bitcoin hovered under $8000, emerging market shares headed for the highest close in six years and Tesla’s shares jumped after the company unveiled two new vehicles, including Semi truck. Trucking company J.B. Hunt said it has reserved "multiple" Semis.

The odds American firms will get a tax break improved Thursday after the House approved its version of the legislation. The Senate is still debating its own plan, trying to reduce the 10-year debt impact below $1.5 trillion. Adding to the discussion, Federal Reserve Bank of Dallas President Robert Kaplan said Friday the government’s debt-to-GDP is possibly at unsustainable levels.

Our Take

From most vantage points over the last year you've had an almost perfect backdrop for equities with an acceleration in nominal growth, earnings between 10%-15% globally and whatever you look at is pretty much in double digits. Nevertheless, last week investors in a choppy trade appeared to be trying to figure out whether benchmarks will continue to march to all-time highs on strong earnings and faster growth spurred by corporate tax cuts or if they will be pulled down amid lofty valuations, the flattest yield curve in a decade (which often signals an impending recession) and a selloff in junk bonds.

In our view the curve is likely reflecting the fact that the Fed will be raising interest rates at the same time that there is virtually no inflation. The short end has risen on Fed rate hike prospects, the long end is not reflecting the potential for growth. Key word “potential”.

On the other hand, in addition to a flattening of the yield curve and a selloff in junk bonds we’ve noticed a few other interesting data points:

-Restaurant sales growth has been slowing at a pace usually seen in a much weaker or even recessionary economy.

-Amid marijuana boom, costs leave analysts dazed and confused. Producer margins could start to shrink as provinces start to purchase pot wholesale. What the price drop will do to margins is nebulous because there isn’t an industry standard for reporting production costs.

-Appetite for risk has increased among money managers to a new high, according to the latest fund manager survey by Bank of America Merrill Lynch (BoAML)

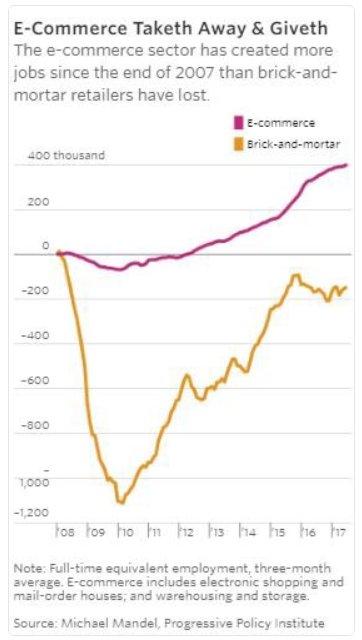

-America’s ‘retail apocalypse” is really just beginning. And this comes when there’s sky-high consumer confidence, unemployment is historically low and the U.S. economy keeps growing. Those are normally all ingredients for a retail boom, yet more chains are filing for bankruptcy and rated distressed than during the financial crisis. That’s caused an increase in the number of delinquent loan payments by malls and shopping centers.The debt coming due, along with America’s over-stored suburbs and the continued gains of online shopping, has all the makings of a disaster. The spillover will likely flow far and wide across the U.S. economy. The ripple effect could also be a direct hit to the industry that is the largest employer of Americans at the low end of the income scale. The most recent government statistics show that salespeople and cashiers in the industry total 8 million.

-Millionaire bankers feel sorry for struggling millennials. Credit Suisse’s Global Wealth Report says those who came of age after the turn of the century have had a “run of bad luck,” and that low wealth tend to be disproportionately found among the younger age groups.

-Firms that burn $1B a year are sexy but statistically doomed. Five outliers — Chesapeake Energy, Netflix, Nextera Energy, Tesla and Uber — have collectively lost $100B in the past decade. Firms that burn piles of cash are often lionised in an era when growth is sluggish and few companies reinvest all their profits. But losing a billion dollars or more a year is a wildly risky affair and the odds are that such businesses will fall flat.

-Artemis Capital Management is comparing the current market state to the Ouroboros – the ancient symbol of a snake consuming its own body.

Musings

Last week, given the significant move higher in one of our holdings (Luxoft Holding Inc: LXFT) which many had left for dead after its last earnings report, I reflected on the ever so difficult question of when to sell. This year at Logos LP we’ve faced this question on both the upside and the downside as certain holdings have skyrocketed while others have slipped.

Overall, the question of when to sell is typically conceptualized as a complicated one. Do you use a simple trigger? Or like Warren Buffett do you only buy certain high quality businesses at such attractive prices that you never have to sell?

As markets continue to edge higher this question becomes all the more relevant as high valuations reduce our margin for error.

For us, the best approach to selling is buying well enough that you don’t really have to follow the stock.

After all, following the stock market too closely is bad for your returns. Most underestimate just how bad it is. Equity investing is mostly characterized by a great irony: if you knew nothing about the stock market and followed little to no financial news, you would probably make a very handsome return on your investment, but if you tried to be a little bit smarter and overloaded on commentary from experienced managers and analysts you probably would perform poorly.

That fact is apparent in the stats, where the average investor earns a return that is less than 1/3 of what they would have earned if they knew nothing and blindly invested in the stock market.

I’ve quoted these stats in other letters but I will do it again: The fact that the stock market rises in 76% of all years, that it gains an average of 7.5% per year and that annual falls greater than 20% occur less than 5% of the time, are ignored in decision making. Since 1980 the S&P has suffered an annual loss of less than 3% an overwhelming 84% of the time. The mind interprets every 10% correction as the beginning of something much worse, even though a 10% fall is a typical, annual occurrence during bull markets.

In a recent blog post on The Fat Pitch, we are reminded that the human mind has a tendency to assess risk based on prominent events that are easily remembered. The 1987 crash, the tech bubble, the financial crisis and the flash crash in 2010 are all events that are easily recalled. The mind automatically assigns a high probability to prominent (but rare) events. It ignores the more important "base rate" probability that better informs decisions.

Thus, when deciding when to sell, keep in mind the “base rate”: although 10% market falls are a typical annual event, the stock market finishes better than that an overwhelming 87% of the time.

Thus, assuming you have bought well or even “relatively well” absent material and significant changes to your evaluation of the business, the decision to sell should typically be obvious. The long-term holder of an asset reaps the advantages lower tax costs, transaction costs, and the significant long-term compounding benefits offered to those who understand the principle of “base rate” probabilities.

Logos LP October Performance

October 2017 Return: +3.86%

2017 YTD (October) Return: +20.03%

Trailing Twelve Month Return: +24.77%

CAGR since inception March 26, 2014: +18.83%

Thought of the Week

"The place in which I'll fit will not exist until I make it." -James Baldwin

Articles and Ideas of Interest

- The Future of Online Dating Is Unsexy and Brutally Effective. Dating apps promise to connect us with people we’re supposed to be with—momentarily, or more—allegedly better than we know ourselves. Sometimes it works out, sometimes it doesn’t. But as machine learning algorithms become more accurate and accessible than ever, dating companies will be able to learn more precisely who we are and who we “should” go on dates with. How we date online is about to change. The future is brutal and we’re halfway there.

- Big data meets Big Brother as China moves to rate its citizens. The Chinese government plans to launch its Social Credit System in 2020. The aim? To judge the trustworthiness – or otherwise – of its 1.3 billion residents. I wonder if North Americans would be into this?

- Are we on the verge of a new Golden Age? History doesn’t exactly repeat itself, but it does run in cycles. One of the most robust theories of such cycles was articulated by economic historian Carlota Perez, in her influential book Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages (Edward Elgar, 2002). It suggests that humanity can get through the current period of upheaval and economic malaise and enter a new “golden age” of broad economic growth, if the world’s key decision makers act in concert to help foster one. This may seem far-fetched, but it’s happened four times before. We are in the midst of the fifth great surge (as Perez calls them) of technological and economic change since the Industrial Revolution.

The upside of being ruled by the five tech giants. The tech giants are too big. But what if that’s not so bad? For a year and a half — and more urgently for much of the last month — there have been warnings about the growing economic, social and political power held by the five largest American tech companies: Apple, Amazon, Google, Facebook and Microsoft. But another argument suggests the opposite — that it’s better to be ruled by a handful of responsive companies capable of bowing to political and legal pressure. The NYT suggests the 3 best arguments on the bright side: 1) They can be governed 2) They hate each other’s guts 3) They are American grown.

- Wall Street’s invasion of the legal weed market. Fascinating account of the race to become the Goldman Sachs of ganja and the Blackstone of bongs.

- FAANG SCHMAANG: Don’t Blame the Over-valuation of the S&P Solely on Information Technology. A small group of technology stocks have recently delivered stellar returns. Facebook, Apple, Amazon, Netflix, and Alphabet (Google), the so-called “FAANG” stocks, are up 36% on average year to date through September. This superlative performance, in such a narrow group of large cap names, has led many to raise questions about the current valuation of the S&P 500, its sector composition, and comparisons to other markets. Interesting report from GMO suggesting that the higher weight in the relatively expensive IT sector is driving some of the expensiveness of the S&P 500, but this does not fully explain the bulk of its high absolute and relative valuation level.

Our best wishes for a fulfilling week,

Logos LP